Our mission

Flourish provides innovative access to financial products that help Registered Investment Advisors secure their clients' financial futures.

Thinking outside the portfolio

While good advisors manage the portfolio, great ones help clients reach their financial goals. And Flourish is here to help advisors:

- Differentiate

- Grow

- Compete

- Deliver more

As advisors face increasing competition from wirehouses to robo-advisors, Flourish helps advisors deliver more ways to support their clients' financial lives while keeping assets in their orbit. From Annuities to Cash to Crypto, Flourish empowers RIAs to offer beautifully-designed solutions that are simple and secure, elevating their brands in a competitive market.

Flourish is building solutions that are custom-designed for RIAs

Invite-only

Secure

Compliant

Integrated

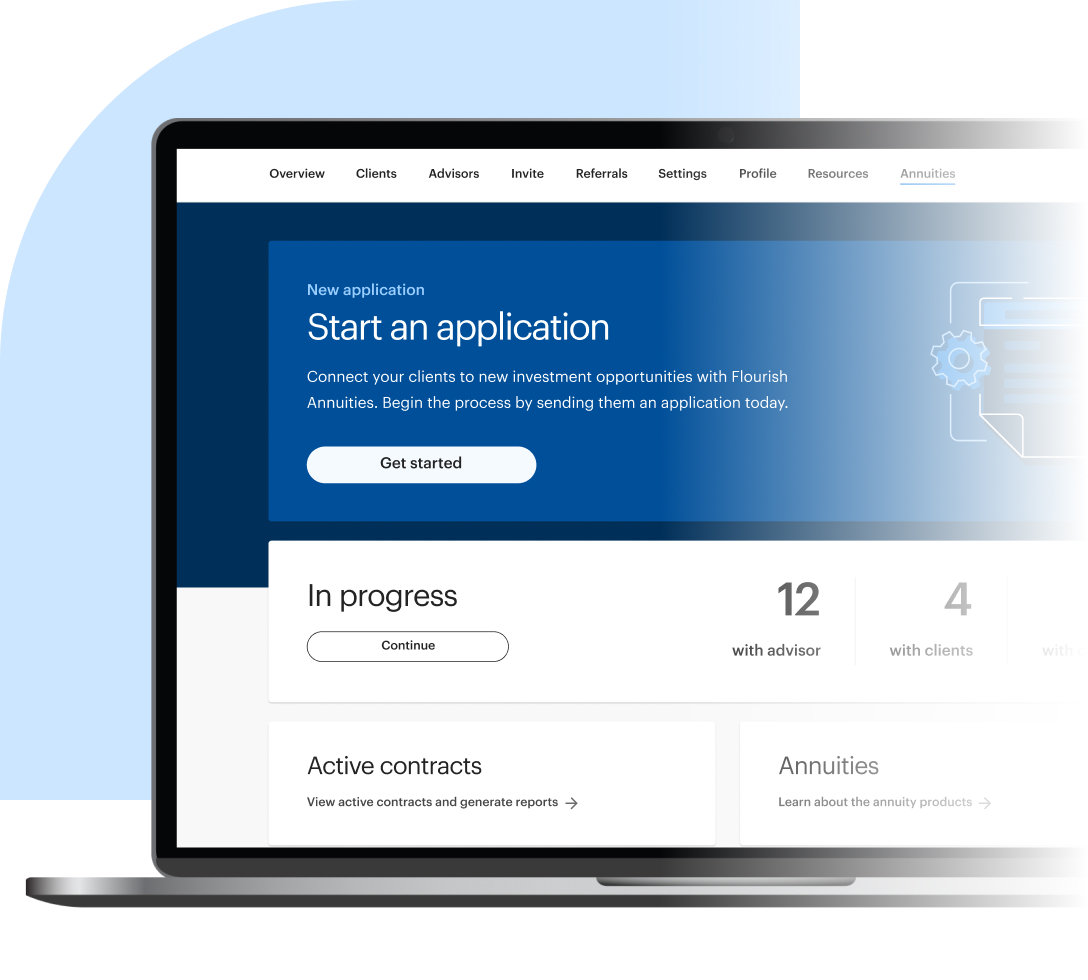

Meet Flourish Annuities*

A modern, digital-first experience that enables advisors to bring fee-based annuities into client portfolios without the need for RIA insurance licenses

-

Competitive rates<

-

Guaranteed, tax-deferred growth††

-

Outsourced Insurance Desk

-

Fee-based for RIAs

- No complicated paperwork

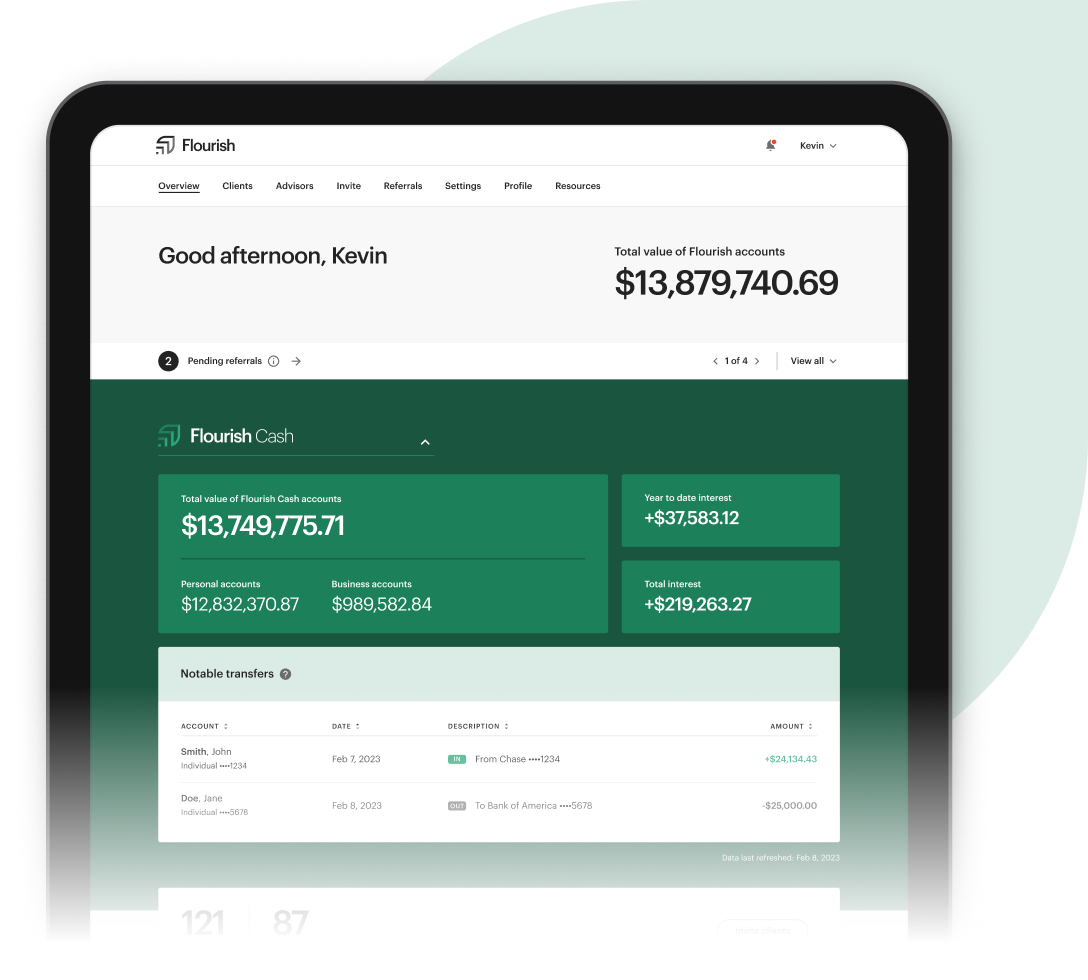

Meet Flourish Cash†

An invitation-only cash account offering rates up to 10x the national savings account average.# Designed exclusively for the clients of independent financial advisors.

-

No Flourish fees ∫ or minimums

-

Easy access with unlimited transfers

-

Integrated with key advisor tools

-

Even more FDIC insurance coverage through our Program BanksΩ

-

Earn a competitive rate – up to 5.00% APY§

This APY applies to the first $1,000,000 in an individual, business, or joint account as described in our rate tier summary. Tiered rates subject to change at any time.

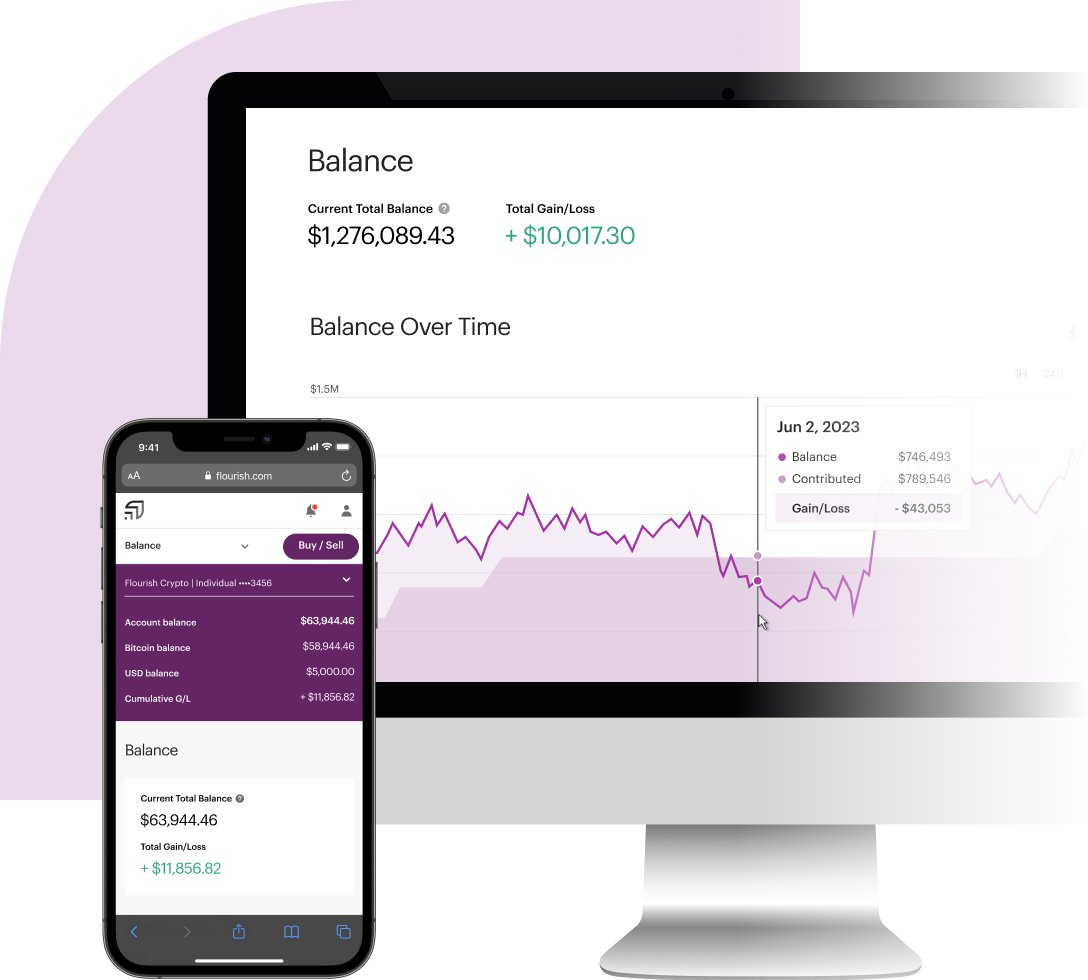

Meet Flourish Crypto◊

A cutting-edge cryptocurrency investing solution that gives advisors a way to offer simple, secure, and compliant access to this emerging asset class to meet the evolving needs of clients.

- Simple, direct cryptocurrency ownership

- $100 minimum trades and 24/7 digital access

- Account opening in minutes

- Custody and execution provide by Paxos, a NY Department of Financial Services regulated cryptocurrency custodian

Flourish by the numbers

2017

Founded

700+

RIAs

$4B+

Assets≈

80+

Employees

The feeling is Mutual

Flourish is wholly-owned by

Flourish joined MassMutual in February 2021 and operates independently from MassMutual’s existing wealth management and insurance businesses.∞ Founded in 1851, MassMutual is one of the largest and most financially stable institutions in the United States. Since the start, MassMutual's singular purpose has been 'to help people secure their future and protect the ones they love.' Our team is deeply aligned with this guiding principle, which is why we're thrilled to have MassMutual’s support.