Up to 3.25% APY§

No minimums. No Flourish fees.∫∫ Unlimited transfers.

Up to 3.25% APY§

No minimums. No Flourish fees.∫∫ Unlimited transfers.

Rate subject to change at any time.

Rate subject to change at any time.

Earn more interest on your cash

Open a Flourish Cash account, fund it from your checking or savings accounts, then sit back. We allocate your money to our FDIC-member Program BanksΩ where it can earn more than 8x the national savings account average.#

Earn 3.25% APY, as described in our program summary.§ Rate subject to change at any time. See our Relationship Summary.

The concept is simple

We are not a bank, but the money you transfer into your Flourish Cash account is automatically deposited at our FDIC-member Program Banks, such as PNC Bank and HSBC Bank.

Your Bank

Flourish Cash

FDIC-Insured Program Banks

Transfer money between your bank

and Flourish Cash.

We deposit into one or more

of the banks we work with.

Your Bank

Transfer money between

your bank and Flourish Cash.

Flourish Cash

We deposit into one or more

of the banks we work with.

FDIC-Insured Program Banks

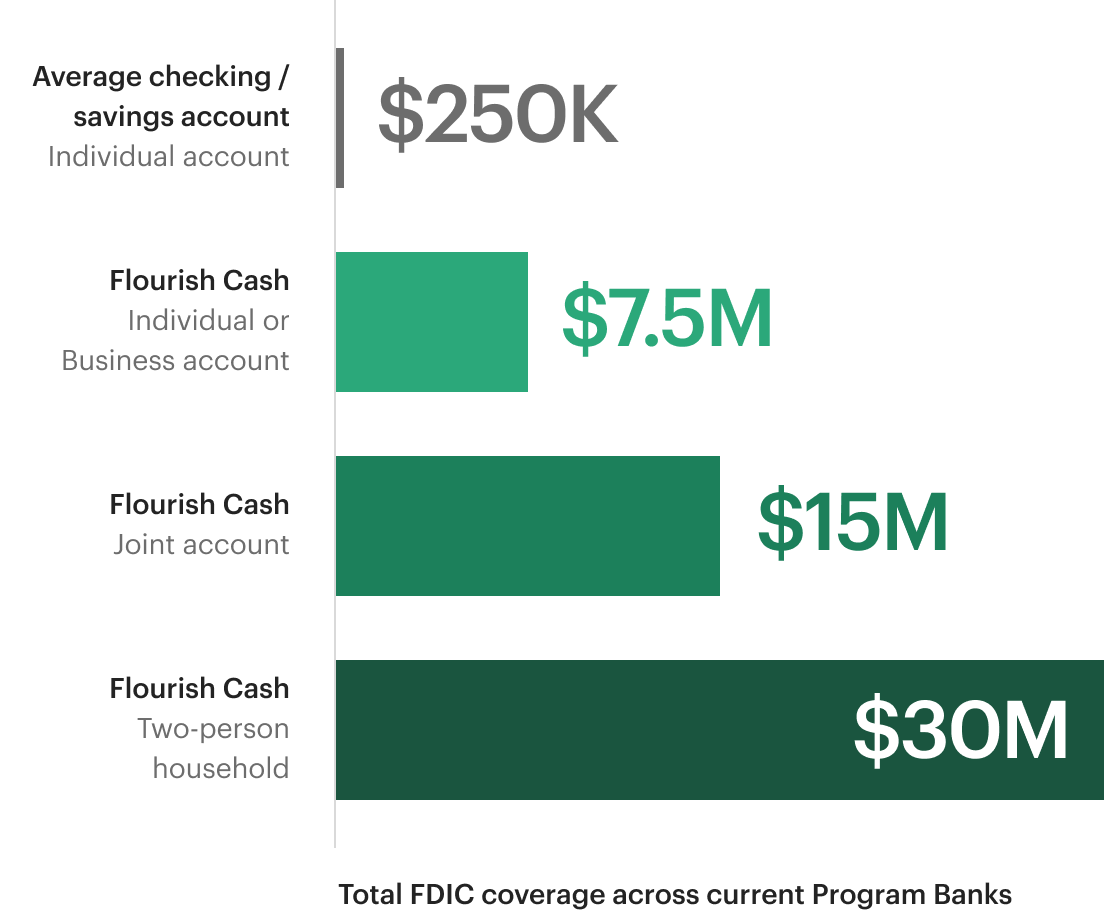

Keep your cash FDIC insured

Consolidate your existing cash balances into one Flourish Cash account and benefit from up to 30x the FDIC insurance limit of a single checking or savings account,Ω as we do the hard work of moving your cash to our FDIC-member Program Banks.

Get more from your membership.

-

Earn a competitive rate on your cash.

Let your cash work harder for you. Transfer in your savings and immediately begin to earn a competitive rate on your cash.

-

No Flourish fees or minimums

Fund your Flourish Cash account with as little as $1. With no fees to open or maintain an account, the rate you see is the rate you get.∫∫

-

Easy access to your money

Automatic transfer tools make it easy to manage your savings, and unlimited transfers mean you always have access to your money.|

-

One statement and tax form

Download one consolidated statement and one tax form. Your accountant will thank you.

Request your invitation

It's quick and easy to create and fund an account.