2024 New Year letter from Flourish CEO, Max Lane:

Empowering advisors to embrace new frontiers

January 4, 2024

Estimated reading time: 6 minutes

Dear Advisors,

At Flourish, we are on a mission to help advisors strengthen their firms and deepen client relationships by delivering innovative, delightful, RIA-centric solutions that improve their clients’ financial lives.

Since our founding, Flourish has been exclusively focused on serving RIAs because of the tremendous role they play in delivering peace of mind to their clients. When people feel secure and confident in their financial lives, they are free to focus on what truly matters most: family, friends, careers, and passions.

However, we see an opportunity for RIAs to have even greater impact. Our industry has evolved from picking stocks, to full portfolio management, to truly holistic financial planning, which is driving advisors beyond the portfolio. The ability of RIAs to implement advice and execute financial plans currently is often limited to the investment portfolio. Yet, the expectation that advisors will provide solutions for every aspect of their clients’ financial lives and deliver even more value is accelerating. In this lies immense opportunity.

With the right tools, RIAs can expand beyond the portfolio and provide solutions for even more aspects of their clients’ financial lives: banking, crypto, insurance, and more. We believe that RIAs should have answers for all their clients' needs and that clients will increasingly rely on you to deliver even more solutions.

Flourish’s pursuit is to make this vision a reality.

As we begin another year, I want to reflect on 2023 and preview how Flourish will continue to partner with you to provide new ways to serve your clients in 2024 and beyond.

2023 highlights

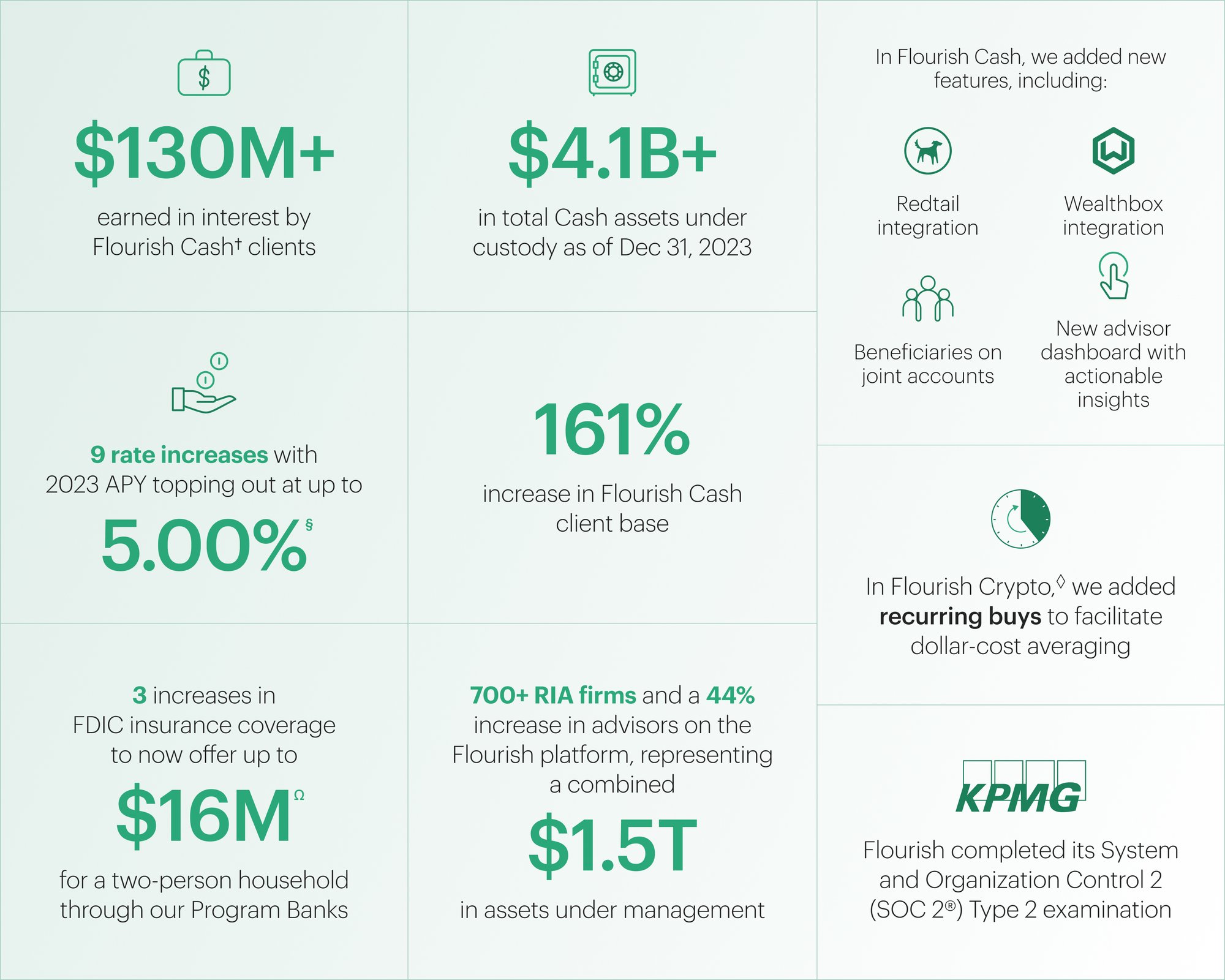

Thanks to your partnership, 2023 was Flourish’s best year ever. We made continuous improvements to our core products through new features, capabilities, and enhancements, setting the stage for an amazing year. Highlights include:||

Adding value

While we are very proud of the numbers above, we are more proud of the impact these numbers represent. Events in 2023 heightened a sense of uncertainty and volatility: inflation and rate concerns, wars in Gaza and Ukraine, bank failures, debt ceiling brinkmanship, recession concerns, the FTX fiasco, and the beginning of the 2024 election cycle. These events not only made your job as wealth managers more difficult but also more important. Simply put, your clients needed you – in the portfolio and beyond.

To demonstrate how advisors delivered value for clients outside the portfolio, I’ll share a few highlights from the past year. In March, we experienced bank failures for the first time in the U.S. since the Great Recession. This bank turmoil left many high net worth individuals, and small business owners in particular, scrambling to ensure that their reserve cash was protected. By utilizing Flourish Cash,† RIAs were able to offer access to elevated levels of FDIC insuranceΩ to swiftly ensure the safety of their clients’ cash. In the tempest, you delivered the safe harbor for your clients.

The extra income from higher yield also had a real impact, particularly on business and non-profit accounts. An advisor who works with many non-profit organizations shared two wonderful anecdotes of how Flourish is helping his clients. One nonprofit was able to streamline its treasury operations with Flourish Cash, generating an additional $250,000 in extra income from earned interest. The increased operational efficiency saved time and freed up capacity to focus on the organization’s core mission while the additional cash helped cover the salaries of several staff members. A second client, an independent school, also began using Flourish Cash as its treasury solution and was able to generate income from interest payments to cover tuition for a few more students that year.±

For me, these examples highlight the critical role advisors play in clients’ lives and the tremendous opportunity we – Flourish and you, our RIA partners – have to do more. This is why we at Flourish are proud of and motivated by our mission.

The new RIA frontiers

The RIA industry has been undergoing a decades-long shift towards holistic planning and deeper client relationships. Yet significant areas of your clients’ financial lives remain entirely outside the advisory relationship.

Advisors have the opportunity to expand their influence beyond the portfolio to new RIA frontiers: banking, crypto, insurance, and more. We’re taking RIAs to these new frontiers.

Cash solutions

The dramatic increase in rates last year highlighted the opportunity cost of advisory clients holding cash savings in a bank account earning nearly 0%. Advisors who provided solutions like Flourish Cash helped clients earn thousands, or tens of thousands, in extra yield while keeping funds protected with expanded FDIC insurance coverage. Clients will come to expect additional banking solutions from their advisors and platforms like Flourish can help you meet those needs.

Crypto solutions

As reflected in the headlines, crypto took a reputational hit in 2023, which, understandably, turned many wealth managers away from this emerging asset class. However, it was another strong year from a return perspective (bitcoin was up over 150% and ethereum up over 80%) and interest in crypto remains strong with around 59% of advisory clients investing in crypto away from their advisor.1 I humbly suggest that many of your clients, and certainly the clients of tomorrow, remain interested in learning more about and potentially investing in digital assets. Crypto remains an RIA frontier worth exploring. As with any investment, crypto is not necessarily a good fit for every client. However, I do believe that every firm should have an advisor-centric crypto solution in its toolkit to help facilitate investments for interested clients and to monitor those investments as part of the overall portfolio and financial plan. Crypto is here to stay and it would be prudent for advisors to have solutions.

Insurance solutions

A final RIA frontier I’ll highlight is insurance. Whether protecting portfolios, income, or wealth, insurance vehicles can deliver valuable guarantees and peace of mind when included as part of a holistic portfolio and financial plan. Yet, insurance continues to be an underutilized tool by RIAs in large part because of its incompatibility with the fee-based, fiduciary RIA model. This has left advisors to direct clients to purchase insurance on their own, refer them to a potential competitor, or avoid the conversation entirely. At Flourish, we believe true fiduciary advisors should have all available tools in their toolkit to create the best outcomes for their clients. We believe insurance is another area of opportunity for RIAs to further add value beyond the portfolio.

The road ahead

In 2024, we will continue to open doors that empower advisors to take on these new frontiers and broaden their impact beyond the portfolio. We are preparing for the launch of a new Flourish product in early Q1 that will expand the advisor toolkit in new ways. In addition, we will continue to enhance our current Flourish products to improve the experience and ease of use for you and your clients through:

- More integrations and features to help Flourish fit into existing advisor workflows

- Ways for advisors to more directly benefit from Flourish

- Enhancements to the end-client experience, tailored to the unique needs of advisory clients

Thank you for being our partners and trusting us to deliver great experiences for your clients. As always, your input heavily influences our views and roadmap. Please reach out to share any feedback on how we could better serve you – I would love to hear from you anytime at ceo@flourish.com.

Wishing you a wonderful, happy, and prosperous 2024,

Max Lane

CEO, Flourish

Max's reading list

Check out what Flourish CEO Max Lane is reading:

- Bloomberg: Bitcoin is earning its place in a balanced portfolio

- Financial Planning: Pros and cons of annuities as havens amid recent market turmoil

- WSJ: Interest rate cuts coming?

- Financial Advisor: Life and Money, Seven Lessons for 2024

- Book: Devil Take the Hindmost: A History of Financial Speculation