Interested in learning more about Flourish Cash?

Help your clients earn more with Flourish Cash†

An invitation-only cash account offering rates more than 9x the national savings account average# and designed exclusively for the clients of independent financial advisors.

Help your clients earn more with Flourish Cash†

4.00% APY§

No minimums. No Flourish fees.∫ Unlimited transfers. Millions in FDIC coverage available through our Program Banks.Ω

Up to 4.00% APY§

No minimums. No account fees. Unlimited transfers.

Rates subject to change at any time.

All rates subject to change at any time.

Built for advisors

- Gain visibility into client account balances

- Provide better advice through integrations with key reporting and planning systems such as Orion, eMoney, and Tamarac

- Engage prospects and start conversations through our built-in referral engine

- Branded with your logo at no cost

- Elevated FDIC insurance coverage through our Program BanksΩ

- Help clients earn a higher rate on their cash – 4.00% APY§

Rates subject to change at any time.

The concept is simple

We are not a bank, but the money your clients transfer into their Flourish Cash account is automatically deposited at our FDIC-member Program Banks, such as PNC Bank and HSBC Bank.

Your Bank

Flourish Cash

FDIC-Insured Program Banks

Clients transfer money between their bank

and Flourish Cash.

We deposit into one or more

of the banks we work with.

Your Bank

Transfer money between

your bank and Flourish Cash.

Flourish Cash

We deposit into one or more

of the banks we work with.

FDIC-Insured Program Banks

Clients keep their cash FDIC insured

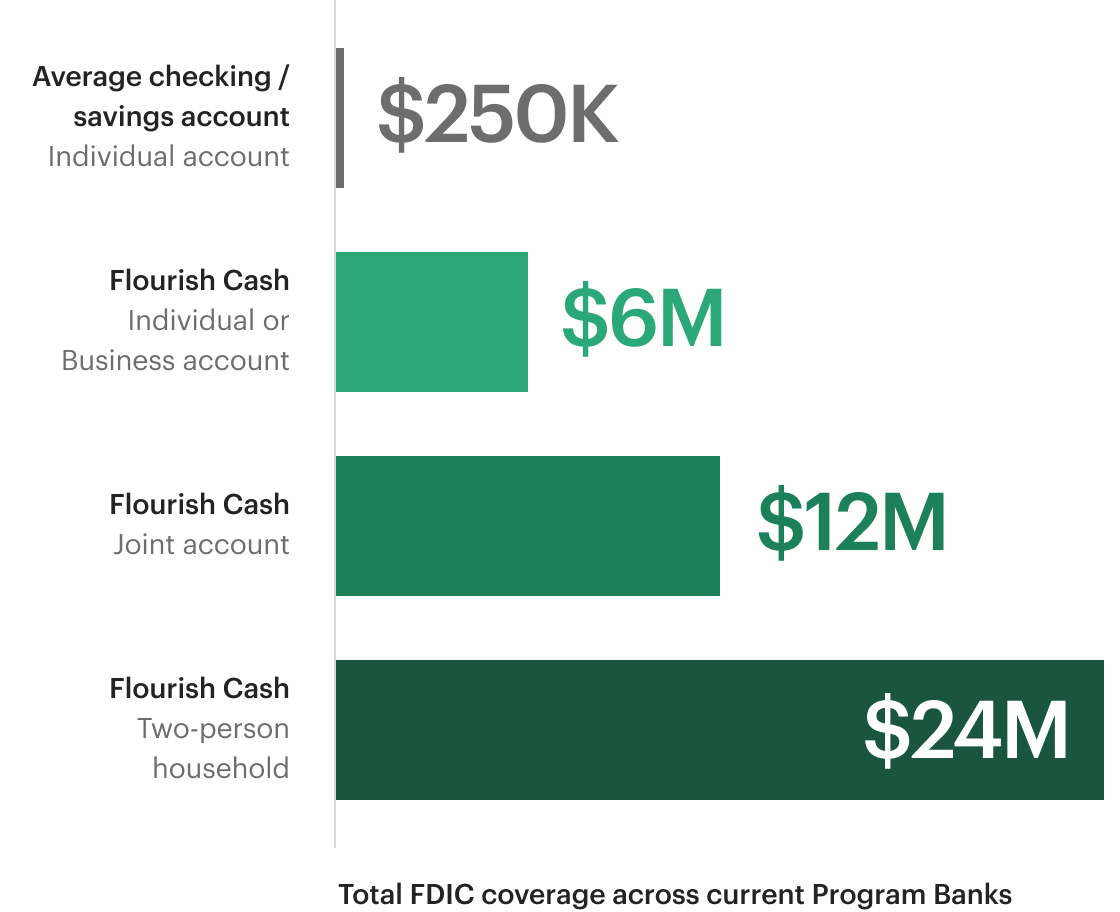

Your clients can consolidate existing cash balances into one Flourish Cash account and benefit from up to 24x the FDIC insurance limit of a single checking or savings account,Ω as we do the hard work of moving their cash to our FDIC-member Program Banks.

Clients get more with Flourish Cash:

-

Clients earn more

A competitive variable rate means clients earn more on their held-away cash.

-

FDIC insured

Up to $6M for individual and business accounts and up to $12M for joint accounts through our Program Banks.

-

No Flourish fees or minimums

Clients can fund their Flourish Cash account with as little as $1. With no fees to open or maintain an account, the rate your clients see is the rate your clients get.∫

-

Maintain liquidity

Automatic transfer tools make it easy for your clients to manage their savings, and unlimited transfers mean they always have access to their money.|

-

Exclusive access

Invitation-only access to the Flourish platform, a beautifully-designed product that is secure and easy to use.

Are you an RIA interested in using Flourish Cash at your firm?

Contact us to request a demo, join a webinar, and learn more today!