Business accounts create new opportunities for advisors to support clients

Last updated: December 11, 2025

Estimated reading time: 5 minutes

- Small businesses and nonprofits are underserved when it comes to options for managing their cash reserves – creating an opportunity for advisors

- Our clients have opened thousands of Flourish Cash† business accounts, from doctors and accountants to foundations and homeowners associations

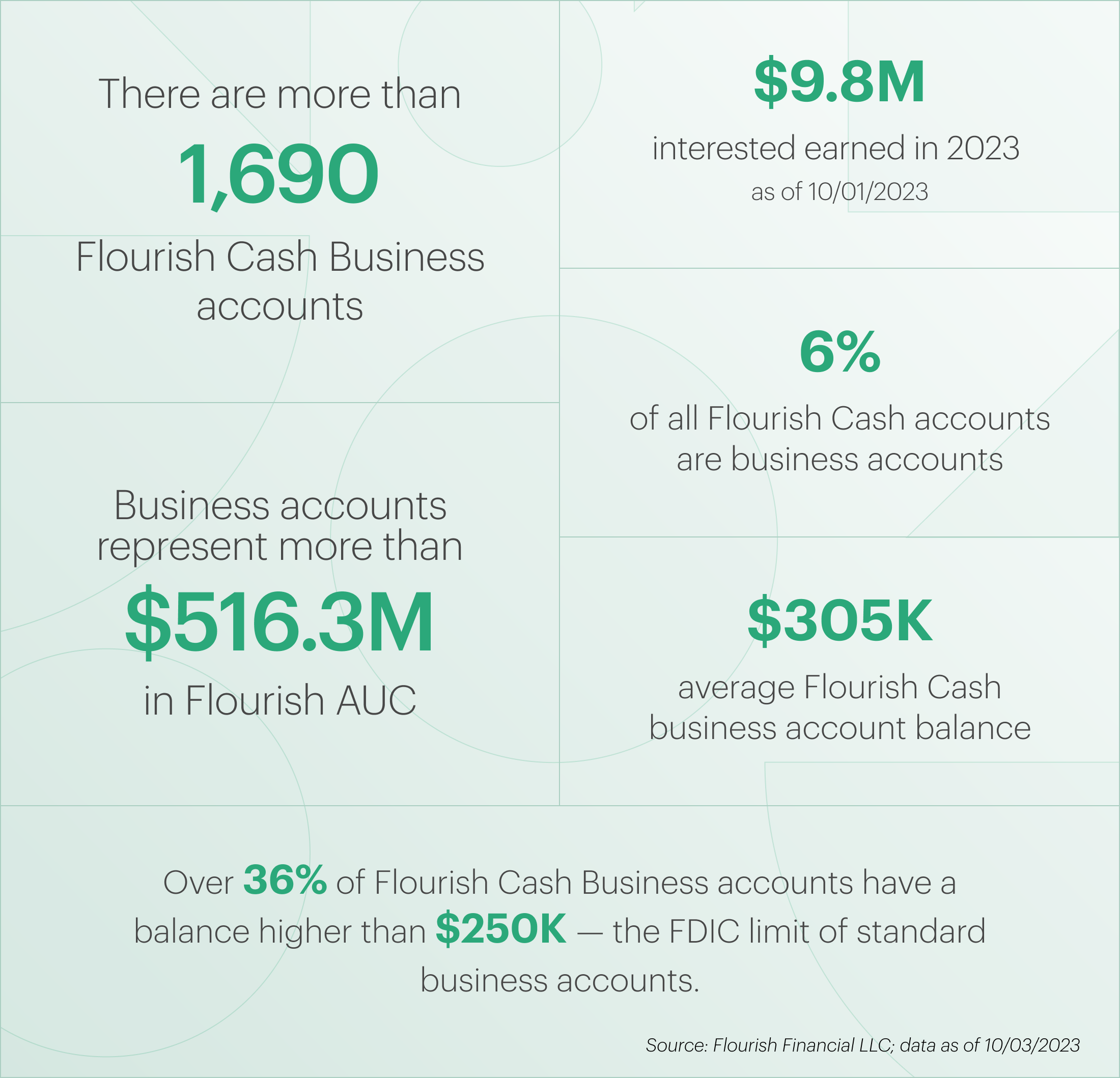

- 36% of Flourish Cash business accounts hold more than $250,000 in cash, demonstrating the need for increased FDIC insurance in this client demographic

- By focusing on helping clients who manage businesses and nonprofits, advisors can

- Add value for small business owners, where planning needs around cash often span both personal and business reserves

- Help clients with non-profit organizations that are close to their hearts

- Gain audiences with key executives at businesses and nonprofits managed by their clients, expanding their prospecting pool

- Advisors who manage retirement plans can deepen relationships with the companies they serve beyond quarterly investment committee meetings

Taking care of a client’s whole financial life is central to the work of a fiduciary advisor, a task that becomes even more important – and challenging – when the client owns a small business or leads a non-profit organization. Accounts designated specifically for business cash reserves can be essential for entrepreneurs and small business owners, but their needs often differ from that of an individual client in distinct ways. And to make things more challenging, the options available to business owners are limited and are often characterized by dramatically lower rates than retail options, cumbersome account opening processes, and frequent restrictions on liquidity.

Advisors who support this growing demographic have the opportunity to build a deeper, stickier relationship with their business-owning clients and expand the potential of their own business in turn.

According to the U.S. Chamber of Commerce, a record-breaking 5.4 million new business applications were filed in 2021.1 Typically defined as a business with less than 500 employees, small businesses make up 99.9% of companies in the U.S.2 “Small businesses play an important role in our country and in the fabric of our society,” said Flourish CEO Max Lane. “They are more likely to be tied to their community and aware of its needs. However, when it comes to financial services, they are often underserved. Small businesses are often more complicated for banks to service than individuals, but don't hold the significant balances of major corporations to warrant an expanded relationship with the bank, creating a gap.”

The financial needs of a small business – from banking and financing to cash flow and tax management – can be vastly different from the financial needs of individuals. Small businesses and nonprofits typically lack the in-house financial expertise that is often central to the successful operation of large corporations. Their owners can struggle to find banking solutions tailored to their specific needs, often navigating this unfamiliar territory on their own.

Effectively managing cash reserves can have a major impact on an organization, creating an opportunity for financial advisors to serve this growing demographic. With cash management solutions becoming an integral part of the toolkit of advisors today, advisors have the opportunity to address the financial needs not only for their clients as individuals, but also to extend additional support to clients who own a business or lead a nonprofit. Douglas Boneparth, a financial advisor and President of Bone Fide Wealth, works primarily with millennial clients, a group that represents twice as many entrepreneurs and small businesses owners as the previous generation.3 “It’s hard to view clients that own businesses in a silo,” said Boneparth. “The smaller the business, the more that business capital is often viewed as personal capital.”

Because of the degree of interconnectedness between personal and business finances, advisors who are not serving the financial needs of a small business, in the end, may not be serving the financial needs of their clients.

Implementing a cash-management solution for business cash reserves has the potential to yield an array of benefits for owners. “There’s a tremendous opportunity for services like Flourish Cash to help small businesses with their reserve cash, adding more protection and helping them earn a better rate,” said Lane. "We frequently hear from small business owners that the rates they earn on their business cash is a small fraction of the rates that they are able to earn on personal cash. While the rate for typical business accounts often can be below 3%, Flourish is proud to pay the same great rate to business owners as we do to retail customers, helping clients of all types achieve their goals."

Flourish Cash is used by thousands of businesses and nonprofits, from doctors and accountants to foundations and home-owners associations. A Flourish Cash business account has the potential to help owners:

- Earn more with a competitive interest rate, 3.25% APY§ as of 12/11/2025

- Rate subject to change. View program summary

- Protect their business cash with up to 30x the FDIC coverage – up to $7.5M – through our Program BanksΩ

- Maintain access to funds with daily liquidity| and unlimited transfers

- Avoid the cost of standard business accounts with no Flourish account fees∫∫ or minimums

- Easily get started with a completely online account opening experience

A cash-management account can support the financial needs of businesses of all types and sizes, but could be most beneficial for businesses that align with certain use cases – in addition to the use cases we explored for personal account owners in The Cash Opportunity. Business accounts could be useful to hold:

- General reserve cash for small businesses

- Endowments of nonprofits

- Annual profit sharing contributions of medical practices, legal firms, financial firms, and more to earn interest on the funds before distributing

- Contributions to HOAs held for repairs, development, etc.

- Quarterly tax payments

- Short-term liabilities

- Funds intended for business expansion

- And much more

Additionally, helping small businesses and nonprofits improve their cash management can potentially provide a substantial source of additional income, as outlined in the next section. This benefit can help business owners increase the financial security of their business and, by extension, themselves – and with extra income and a stronger sense of security comes increased peace of mind.

Business accounts comprise more than 12% of Flourish Cash assets under custody, which include LLCs, partnerships, corporations, and non-profit organizations. Businesses with a self-reported annual revenue under $10M hold an average of $172,560 in their Flourish Cash accounts, and those with over $10M hold an average of $471,517 in their accounts. At our rate of 3.25% APY§ as of 12/11/2025, the business with under $10M in revenue would earn more than $5,600 in annual interest and the business or nonprofit with over $10M in revenue would earn more than $15,300 in annual interest.|| “Right now, there’s really no excuse not to get a higher yield. If you’re getting 1-2% on your cash, you’re losing,” said Boneparth.

More than 36% of Flourish Cash business accounts hold more than $250,000 in cash as of October 2023|| – the FDIC insurance limit for a typical checking or savings account. While the opportunity to earn a competitive rate has clear financial benefits, recent turmoil in the banking industry has brought FDIC concerns to the forefront, not least for business owners. “As our data shows, business owners are far more likely to need elevated FDIC insurance. Banking solely at one bank and only getting $250,000 in FDIC coverage often results in having a part of the balance unprotected,” said Lane. “With FDIC insurance coverage through our Program Banks up to $7.5M,Ω which is up to 30x the limit of a single standard checking or savings accounts, Flourish is a great way to insure a larger portion of the balance.”

Based on conversations with hundreds of advisors, we’ve commonly heard three key benefits to focusing on businesses and nonprofits:

- Deepen relationships with clients

Advisors who provide financial advice to individuals who manage a small business or nonprofit aren’t necessarily involved in the financial and tax planning for that business. However, that doesn’t mean that the business’ finances are out of their realm of influence. Advisors should embrace the chance to help small businesses and nonprofits, even if they don’t have a direct relationship with the business entity itself, as a powerful opportunity to improve the relationship. - Help the business, help the client

Rather than viewing the small business or nonprofit as a distinct entity, advisors would be well served to see it as an extension of the client. “If you can help improve the business in some small way, it can only benefit the advisor who, of course, wants a deeper, stickier, more meaningful relationship with their client,” said Lane. Even if the advisor isn’t managing the wealth of that business directly, providing access to a business account serves as another touchpoint for the relationship and can have positive repercussions that deepen and improve the relationship. - A powerful prospecting engine

Offering business accounts can be a differentiator for firms and a potential growth driver:

- Many advisors have found success with offering Flourish Cash invitations to prospective clients. Flourish Cash provides advisors with the ability to immediately add value – long before advisory agreements are signed and assets transferred over – while prospective clients will be reminded of your brand every time they log in to Flourish.

- By helping out businesses and nonprofits managed by current clients, for example, advisors may be able to secure audiences with key executives and board members that may turn into private wealth leads.

- For advisors that manage retirement plans, offering Flourish Cash Business accounts can be a powerful way to increase mindshare with CFOs outside of quarterly investment committee meetings – while the ability to offer Flourish Cash personally can be a powerful way to start the private wealth conversation with key executives at the businesses you serve.

About Flourish

Flourish builds technology that empowers financial advisors, improves financial lives and retirement outcomes, and delivers new and innovative investment options to advisors. Today, the Flourish platform is used by more than 1,000 wealth management firms representing more than $2.6 trillion in assets under management. Flourish is wholly-owned by MassMutual. For more information, visit www.flourish.com.