Business owners: Achieve more with a Flourish Cash account

Last updated: December 11, 2025

Estimated reading time: 3 minutes

Cash flow for a small business can be volatile and business owners recognize that reserve funds provide a safety net for times of uncertainty or when unexpected expenses arise.

Key takeaways:

- Businesses of all types have added Flourish Cash† to their financial management toolkit, including nonprofits, medical offices, homeowners associations, rental property LLCs, investment partnerships, and more.

- Small businesses need cash on hand for a variety of reasons, from paying quarterly taxes to planning for year-end profit-sharing distributions to saving for capital expenditures.

- Many business banking accounts offered by traditional banks have low interest rates and challenging limitations, including transaction fees, minimum balances, and the standard $250,000 FDIC insurance limit. In contrast, Flourish Cash offers the same great rate, flexibility, and experience to business owners as personal wealth clients.

Typical business banking challenges:

Although small businesses — defined as organizations with fewer than 500 people — represent 99.9% of all companies in the U.S., they often struggle to find banking solutions tailored to their needs.1

Large financial institutions, which have historically dominated the banking landscape, are well-versed in serving individual retail clients and large commercial banking customers. However, this paradigm has left small businesses without a solution that’s truly tailored to their needs.

Many business banking products offered by traditional banks have significant limitations, ranging from account minimums to low interest rates. Some may cap the number of fee-free monthly transactions or otherwise limit withdrawals. It’s not uncommon to see charges for essential business banking services, like ACH transfers.2

Within their own four walls, small businesses face additional challenges in managing their finances. Unlike their larger corporations, they often do not have dedicated finance teams, which may lead them to focus on managing the basics, such as cash inflow and outflow, rather than exploring opportunities to grow their business through strategic financial management. Without an in-house team, these small businesses may struggle to hold adequate reserves to meet short- and medium-term needs while remaining below the $250,000 FDIC-insured limit.

How Flourish Cash solves for these common business banking hurdles:

With Flourish Cash, business owners have access to a flexible cash account without the limitations of a traditional bank. A Flourish Cash business account offers all the same benefits of personal Flourish Cash accounts:- No fees ∫∫

- No minimum balance requirements

- Unlimited, same-day transfers|

- Competitive APY§ that is up to 8x more than the national savings account average#

- Up to $7.5 million in FDIC insurance coverage through our Program BanksΩ

A Flourish Cash business account also offers clients versatility. For the business owner looking for an account to hold funds for their immediate needs – while still earning a competitive interest rate that can meaningfully contribute to profits – they are better served with unlimited, same-day transfers. For those looking for a more secure solution for medium- and long-term cash needs, they have access to an account that offers up to 30x more FDIC coverage through our Program Banks. For those working for a nonprofit looking for a way to maximize every dollar, moving funds from a traditional bank offers the opportunity to earn an interest rate up to 8x higher, which can translate to expanded initiatives.

Is Flourish Cash right for your small business?:

A Flourish Cash business account is suited for businesses of all shapes and sizes — any corporation, nonprofit, LLC, or partnership is eligible to use a Flourish Cash account. Our clients include:- Small businesses

- Non-profit organizations

- Medical offices

- Solopreneurs

- Homeowners associations

- Rental property LLCs

- And much more

How you use the account for your business is up to you. A Flourish Cash business account typically holds reserve cash, but the use cases vary from business to business:

- Businesses with an equity partnership model can earn interest on their annual profit-sharing contributions prior to distribution

- Non-profit organizations often maintain a portion of their endowments in cash

- Homeowners associations or rental property LLCs can hold HOAs or reserves for repairs, development, or capital improvements

- Solopreneurs, which account for 81.7% of all small businesses, can centralize their financial life by holding business cash in a Flourish account

- Businesses of all types use their Flourish Cash account to save for medium-term business costs, such as quarterly tax payments, short-term liabilities, or funds earmarked for business expansion

A Flourish Cash account is visible to your financial advisor. This provides them with a comprehensive picture of your personal and business holdings, empowering your advisor to offer more tailored and informed financial guidance.

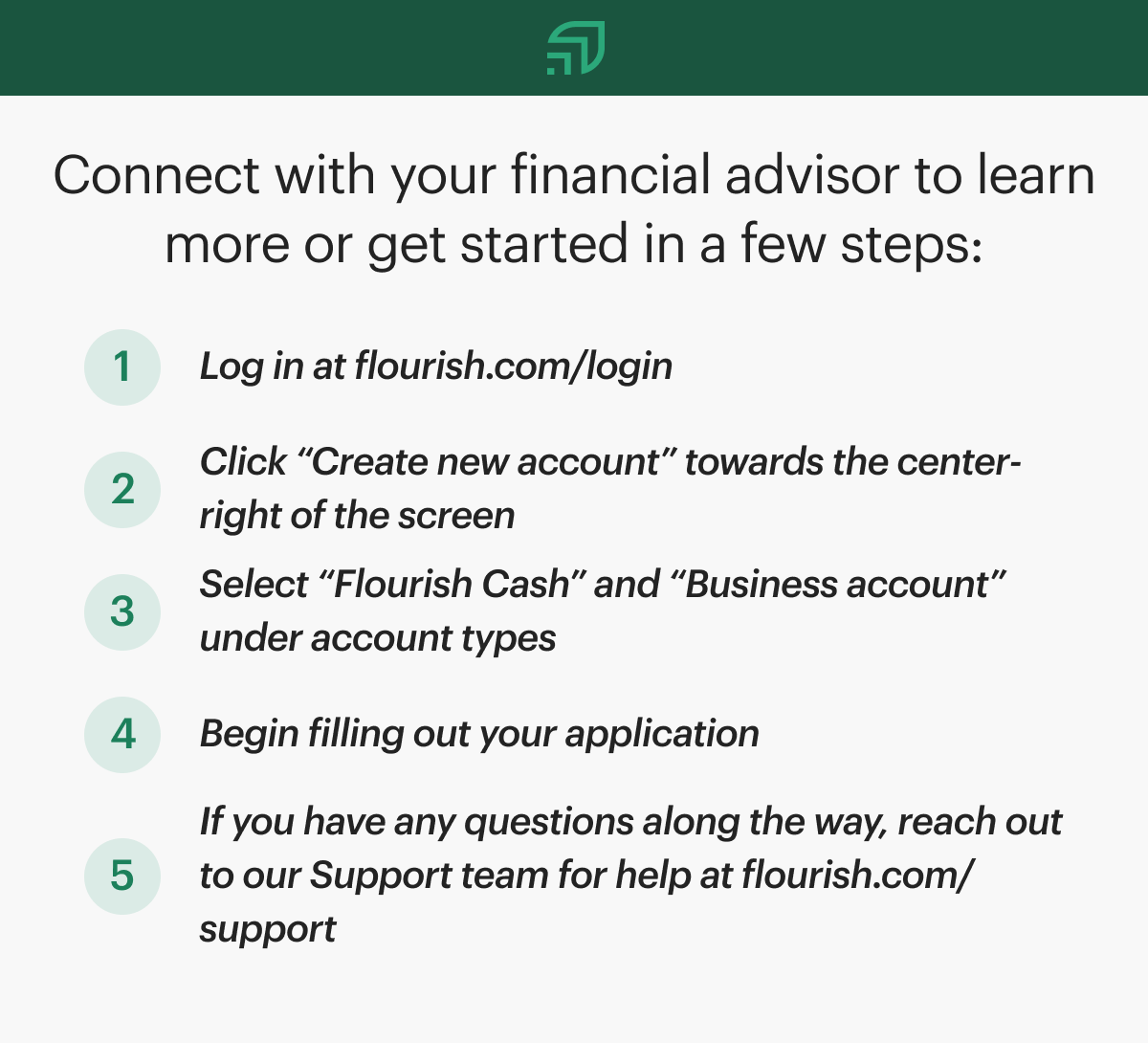

Ready to learn more about Flourish Cash? Check out our product page, then chat with your financial advisor about setting up a Flourish Cash account for your business or get started with the instructions above.

How Flourish Cash has helped businesses:

About Flourish

Flourish builds technology that empowers financial advisors, improves financial lives and retirement outcomes, and delivers new and innovative investment options to advisors. Today, the Flourish platform is used by more than 1,000 wealth management firms representing more than $2.6 trillion in assets under management. Flourish is wholly-owned by Massachusetts Mutual Life Insurance Company (MassMutual). For more information, visit www.flourish.com.