Add client value and drive growth with Flourish Cash

3.25% APY§

Flourish Cash† is an invitation-only cash account designed exclusively for the clients of independent financial advisors

No account minimums

No Flourish fees∫∫

Unlimited transfers

More than 8x the national savings account average#

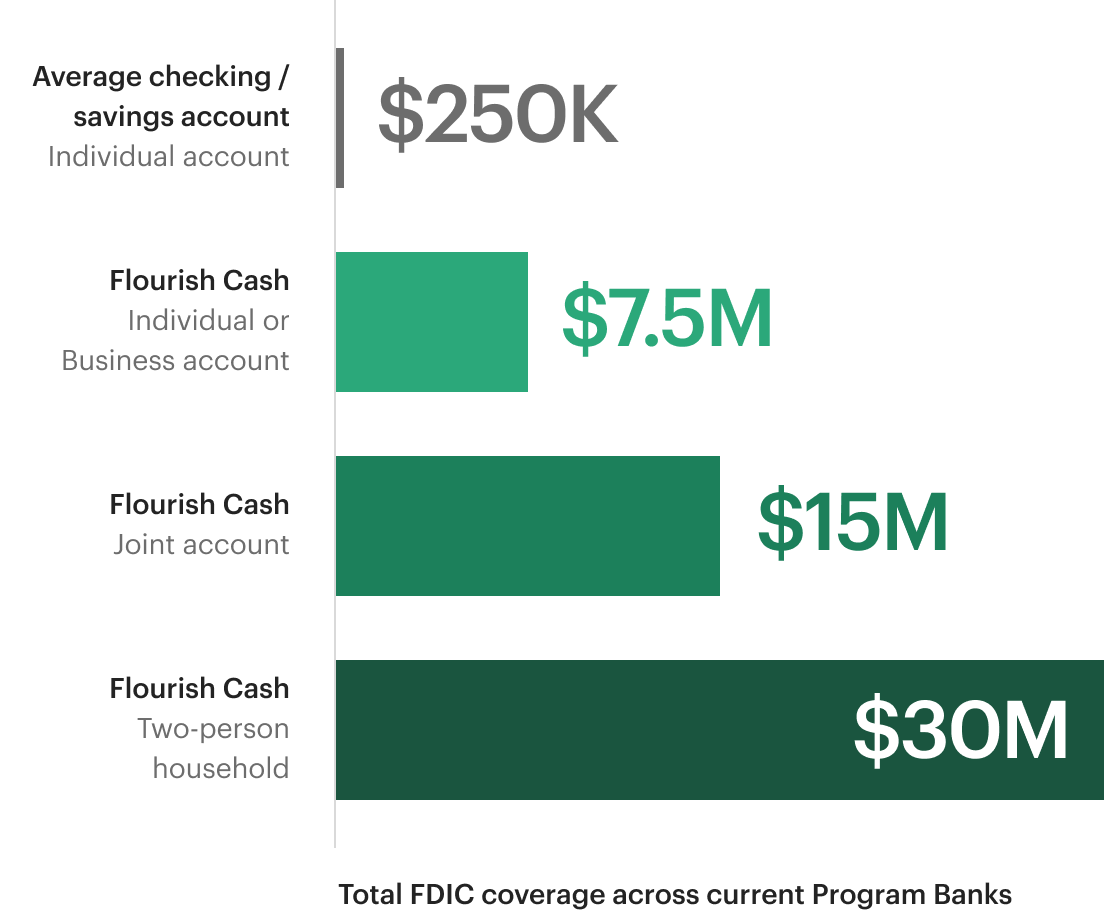

Up to 30x the FDIC insurance coverage through our Program BanksΩ

Individual, joint, and business accounts

Rate subject to change.

This form is for Registered Investment Advisors only. If you are an individual investor, please contact your advisor for an invitation!

"When Flourish was introduced to us, a light came on. Since then, we’ve incorporated holistic cash management into discussions with every single client."

– Ryan Huey, President of RoseRock Wealth Management±

Four simple steps to get clients started

Every client has cash

Start the conversation today to help them earn more and drive firm growth.

Built for advisors

- Easy-to-use cash management solution for clients' held-away cash, or for use alongside existing brokerage accounts†

- Branded with your logo at no cost

- Bring excess cash into the portfolio — over $675M has been transferred from Flourish Cash accounts to custodians||

- Provide better advice through integrations with key reporting and planning systems such as Orion, eMoney, and Envestnet

- Engage prospects and build relationships with your clients' networks through Flourish's built-in referral engine

Clients get more with Flourish Cash

-

Up to 3.25% APY§

A competitive variable rate means clients earn more on their held-away cash

-

30x FDIC coverage

Up to $7.5M for individual and business accounts and up to $15M for joint accounts through our FDIC-member Program BanksΩ

-

No Flourish fees or minimums

Clients can fund their Flourish Cash account with as little as $1 — with no fees to open or maintain the account, the rate your clients see is the rate your clients get∫∫

-

Maintain liquidity

Automatic transfer tools make it easy for your clients to manage their savings, and unlimited transfers mean they always have access to their money|

-

Exclusive access

Invitation-only access to the Flourish platform, a beautifully-designed product that is secure and easy to use

Ready to start using Flourish Cash at your firm?

Contact us to request a demo and learn more today!