Deliver more value. Unearth new assets. Drive prospecting.

Flourish Cash† is designed specifically for advisors to deliver value while bringing held-away cash into your orbit.

Curious how Flourish Cash compares to common cash instruments, such as MMFs, Treasurys, and CDs? Learn more.

1,000+

RIAs using Flourish

$8B+

Assets under custody≈

40k+

Clients

Deliver more value

Enhance short-term planning and portfolio-management decisions. Interest earned could offset client advisory fees, fund a vacation, or contribute to long-term goals.

Unearth new assets

Visibility helps advisors understand client goals and start a conversation about cash, which could open the door to moving funds to the portfolio.∆

Drive prospecting

Engage prospects, including next-gen clients and business owners, with an invitation-only, branded solution.

FOR ADVISORS

Designed to deliver value while bringing held-away cash into your orbit

- Invitation-only, available to both clients and prospects

- Can be branded with your logo

- Visibility into balances, statements, 1099s∆

- Easy to set up standing instructions (e.g. Schwab MoneyLink)

- CRM, portfolio reporting, and planning tool integrations

- Built-in referral engine

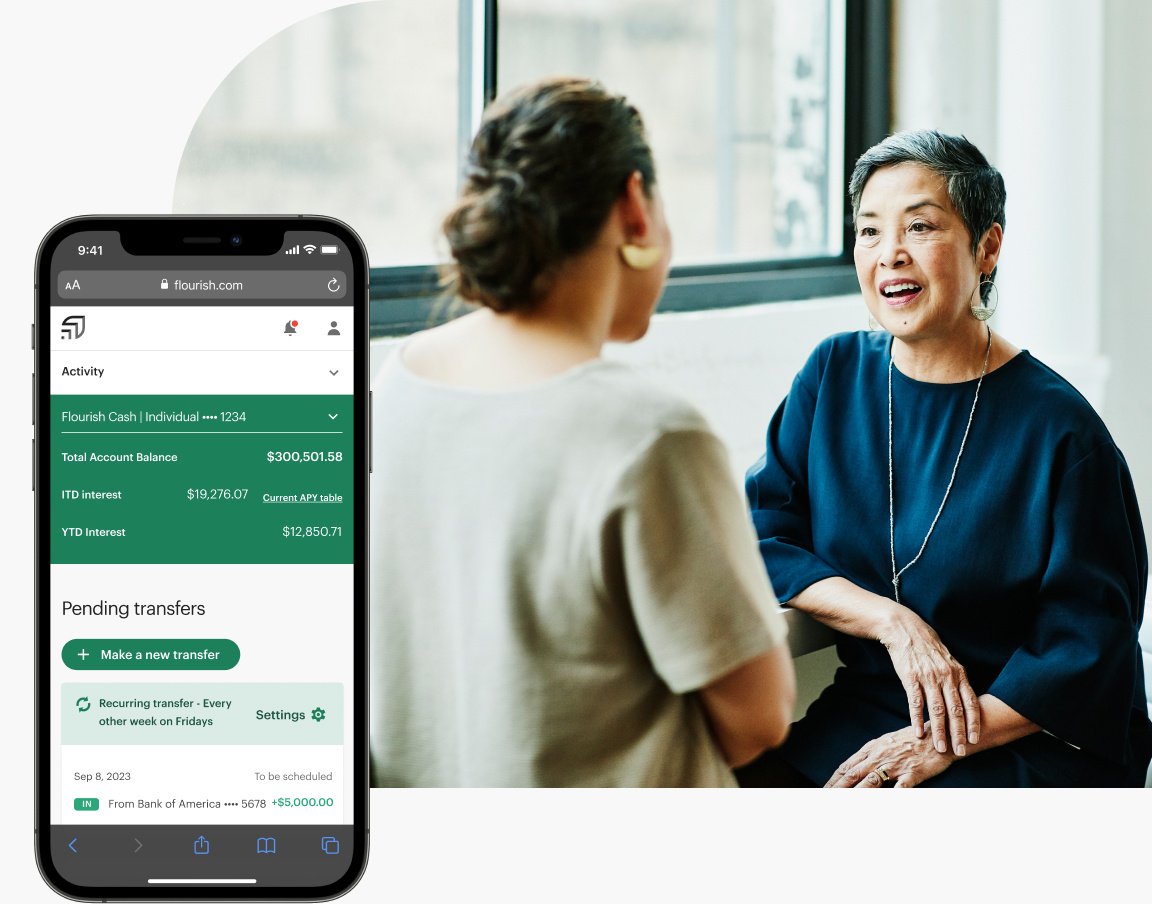

FOR CLIENTS

A cash-management account

for reserve cash

- Competitive variable rate§

- Up to 30x more FDIC insurance coverage for a two-person household than a single checking or savings account through our Program BanksΩ

- Minutes to sign up

- $0 minimum

- No Flourish fees ∫∫

- Unlimited, same-day transfers|

- Support for individual, joint, revocable trust, and business accounts

Activate your Flourish Advisor Account

- Open the invitation email sent to your firm email address from support@flourish.com

- Didn’t receive an email? Reach out to your firm administrator or email advisor@flourish.com

- Set login credentials (your username will be your firm email address)

- Set up 2-factor authentication

Invite clients

- We encourage every advisor to invite themselves as a personal client (using your personal email address) to see the client experience firsthand

- Click Invite to Cash

- Fill in your client’s first name, last name and email address

- Optional: add a household partner by clicking + Add household partner

- Click Continue and choose Invite Only or Prefill Application

- Invite Only will send your client an invitation to fill out an application for Flourish Cash

- Prefill Application allows you to start the application process on behalf of your client before sending them an invitation to review and submit the application. Fill out as much or as little of the application as you’d like.

- Learn how to start the cash conversation with clients

Explore resources

- Navigate to the Resources tab within the Flourish portal

- Download client factsheets, marketing templates, and more

QUICK LINKS

SUPPORT

Support Desk

Call (833) 808-5700

Email: support@flourish.com

Monday – Friday 9 AM – 6 PM ET

Advisor Relationship Management

Email: advisor@flourish.com

Insights Articles

How to start the cash conversation

A step-by-step guide to successfully rolling out a cash-management solution to current, new, and prospective clients.

Watch the Cash Awakening webinar

Exploring the CIO perspective on how Flourish Cash works along money market funds, Treasurys, and other cash equivalents in the advisor toolkit.

The benefits of business accounts

Small businesses and nonprofits are often underserved when it comes to options for managing their cash reserves – creating an opportunity for advisors.

Seven steps to a successful rollout

We share a seven step process for RIAs to get started with Flourish Cash.

The Flourish Cash business model

Understanding the difference between the rates that Flourish Cash offers and the rates offered by banks.

Our bank due diligence process

An overview of the Flourish Cash Program Bank Network and our bank due diligence and risk monitoring process.

Frequently Asked Questions

How does Flourish Cash make money?

Flourish Cash makes money on the spread between the rate the Program Banks pay Flourish and the rate that is passed along to clients.

How often does your rate change?

The Flourish Cash rate is most closely tied to the Federal Funds Rate and typically changes with rate movements.

How is Flourish able to pay great rates?

Flourish Cash† gives customers access to a competitive interest rate and more FDIC insurance coverage through our Program Banks. Learn more

What does Flourish invest in?

Client funds are never invested! Client funds are held in cash in depository accounts at our Program Banks.

How does Flourish Cash compare to other cash instruments?

- Competitive rate

- No set terms or lockups – funds remain liquid

- Looks and feels like an online savings account, even though it is a brokerage account

- Easier access to cash compared to many other cash instruments

- Clients can initiate transfers by themselves through their portal

- Immediate access to funds with complete liquidity

- Built for RIAs, from branding to integrations to white-glove client support

What is the Program Bank due diligence process?

This article offers an overview of the Flourish Cash Program Bank Network, Flourish’s Bank Risk Committee, our bank due diligence and risk monitoring process, and Program Bank opt-out functionality.

Who are your Program Banks?

We are proud to partner with a diverse group of banks – from small to large in size and regional to global in scale – to bring you Flourish Cash. See our complete list of Program Banks.

How long do transfers take?

Transfers are available as soon as same-day. Click here to see full transfer timelines.

On weekdays, if you initiate a transfer before 7am ET then your funds should arrive in your destination account at 2pm ET that same day for both deposits and withdrawals. If you initiate a transfer before 3pm ET, the funds should arrive at 6pm ET. Transfers initiated over the weekend will arrive next business day.

There is a four calendar-day hold to withdraw funds to newly added bank accounts. Newly deposited funds are subject to a 3-business day hold before they can be withdrawn. Click here to see transfer restrictions.

Is there a minimum to use Flourish?

There are no minimums for clients or advisors.

What can an advisor do on behalf of clients?

Advisors can:

- View Flourish balances, external bank balances, transfer account information and documents∆

- Prefill applications on behalf of clients

- Set up standing instructions to custodians and brokerage accounts

- Provide certain documentation on behalf of clients

Advisors cannot:

- Initiate transfers on behalf of clients from within the Flourish portal

- Change information on behalf of clients

Can I initiate transfers to and from brokerage accounts?

Yes, advisors can create connections between Flourish Cash accounts and brokerage accounts in order to push and pull money from your existing custodial platforms. This is done through forms like Schwab’s Moneylink or Fidelity’s Standing Instructions. How to set up connections to brokerage accounts

As an advisor, can I set up a Flourish Cash account for myself?

Absolutely. Within the advisor portal, navigate to the ‘Invite’ tab and type in your first name, last name, and personal email address then click “Continue.” Click “Invite Only” and “Send Invite”, then find your invitation email to see the entire client experience firsthand.

How can I turn off visibility into my own personal accounts?

- Personal/business account advisor visibility: When set to "On", your firm and its personnel will be able to view information for each of your Flourish Cash† personal (individual, joint, or trust) accounts, including balances and transactions, programmatically linked bank account balances, and other information.

- ACH account and routing number visibility: When set to "On", your firm will be able to view your Flourish Cash† account and routing numbers. They will also be able to download a letter containing this information that can be submitted to other financial institutions to verify your account's information for transfers.

- Documents visibility: When set to "On", your RIA firm will be able to view your account documents, including statements and tax forms.