Quantifying the cash opportunity:

A framework for estimating clients' held-away cash

September 18, 2025

Estimated reading time: 3 minutes

At Flourish, we aim to help advisors tap into the cash opportunity to add value for clients and differentiate their practice. Flourish Cash† gives clients access to a cash account with competitive rates§ and enhanced FDIC coverage through our Program Banks.Ω Advisors, meanwhile, benefit as Flourish makes held-away cash visible and opens new paths to organic growth.∆

However, because cash has not traditionally been an area of focus for advisors, we often receive questions — both from individual advisors and from firm executives — about the size of the opportunity. How much cash is actually out there? And how much of it could your firm realistically expect to capture?

Over the years, we have developed a simple framework to help advisors and firms quantify the potential upside of presenting clients with a cash solution.

Our methodology to assess the cash opportunity begins by considering your firm’s AUM that is attributable to personal clients (e.g., not institutions or retirement plans); while the assets you manage are not directly related to the funds that end up in Flourish Cash, your firm AUM is closely correlated with how much cash is out there. From there, we make several assumptions as discussed below that drill down from the theoretical maximum total cash outstanding of your client base to a more realistic picture of what strong client adoption of Flourish Cash would look like.

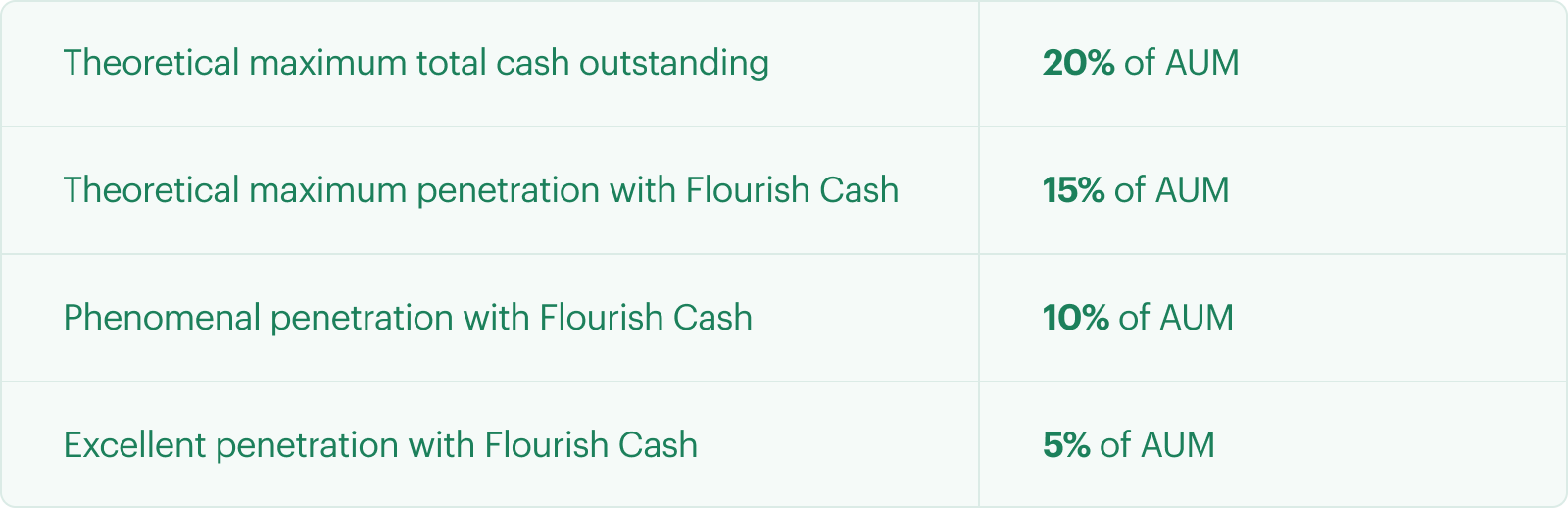

Starting at the maximum total cash outstanding and working toward what we call phenomenal penetration with Flourish Cash, we have identified the following benchmarks:

To note, this is simply a framework: we work with a number of firms that have exceeded the “Theoretical maximum penetration with Flourish Cash,” whether because their clients hold a disproportionate amount of cash, or because they heavily utilize Flourish Cash with segments that are poorly proxied by AUM — such as business owners or prospects. With that said, this framework has proven to be a helpful and reliable starting point for assessing the cash opportunity.

-3.png)

.png)

Numerous studies show that high net worth individuals (HNWIs) hold approximately 20% of their wealth in cash.1 From here, we make the assumption that roughly 20% of your firm’s AUM represents your clients’ total cash holdings. For a firm that manages $1B in assets for personal clients, that means your clients could have $200M+ in cash on the sidelines.

There are a variety of macroeconomic forces, personal traits, and life factors that can influence whether your clients hold more or less cash than the average investor. If you wish to adjust this baseline calculation, you can factor in specific details you know about your client base and adjust this 20% assumption upward or downward, as needed.

Some of a client’s decisions about cash are driven by behavioral factors. As an example, research from Vanguard showed that in 2022, as anxieties about the market rose, more clients tapped retirement funds and converted some of those assets into cash.2

A client’s stage of life may also influence the amount of cash they hold. Research shows that HNWIs of the silent generation hold an average of 23% in cash. In contrast, cash reserves for high net worth millennials represent 11% of their total assets.3

You know your broader client base and their needs in the current macroeconomic environment best, and so may wish to adjust our general 20% AUM assumption up or down to account for the realities of your book of business at any given time.

-1.png)

.png)

Once you’ve settled on a figure for your theoretical maximum total cash outstanding, you can turn your focus to what Flourish Cash penetration might look like at your firm.

While your clients may hold 20% of their total wealth in cash, not every dollar will end up in a Flourish Cash account. Some of those dollars will likely remain in checking and savings accounts at other institutions, while other clients will hold some amount of cash in the portfolio.

Here, we can turn to a representative data point from existing Flourish Cash clients. Clients with a self-reported net worth of $1-2M have an average Flourish Cash balance of $217.6K, or 14.5% of their net worth in cash.||

Assuming that your average client will hold ~5% of cash elsewhere and ~15% of cash in a Flourish Cash account, you can multiply your AUM by 15% to discover the total addressable pool, if every client adopts the product. For that $1B firm, that means approximately $150M in cash might be addressable.

.png)

.png)

Of course, assuming 100% adoption of any product is unrealistic. Some clients may already have funds at a high-yield savings account and be reluctant to explore other options; others may be tech-averse and disinclined to use an online banking product.

You may also have limitations on the firm side. Some advisors may be uninterested in providing clients with a cash solution or simply forget to incorporate it into their typical talking points, leading to lower adoption rates.

Our qualitative and quantitative data suggests that firms who are close to 100% adoption wind up with 10% of AUM in Flourish Cash accounts.4 We consider this to be “Phenomenal penetration” for the product, and it is a figure that’s likely most achievable by firms that adopt a streamlined process for internal rollout. Conversely, 5% represents truly “Excellent Penetration” — and more often than not, is a firm that is well on their way towards 10%.

For our representative $1B firm, that means $50-100M in cash.

.png)

.png)

When advisors log in to the platform, they can access a variety of ready-to-go materials in the Advisor Resource Center that can help introduce Flourish Cash to internal teams of advisors, help advisors introduce clients to the solution, and help share the opportunity in marketing communication. The story is simple, the benefits are clear, and the opportunity is vast.

Ready to learn more about how adding Flourish Cash to your offerings can deliver better results for your clients and firm? Visit our product page for additional information.

About Flourish

Flourish builds technology that empowers financial advisors, improves financial lives and retirement outcomes, and delivers new and innovative investment options to advisors. Today, the Flourish platform is used by more than 1,000 wealth management firms representing more than $2.6 trillion in assets under management. Flourish is wholly-owned by Massachusetts Mutual Life Insurance Company (MassMutual). For more information, visit www.flourish.com.