The Cash Opportunity for Advisors:

Why advisors are blind to held-away cash

Last updated: December 11, 2025

Estimated reading time: 5 minutes

With interest rates near historical lows for the past decade, investors and advisors alike could afford to ignore cash. But when rates started to climb to their highest point since 2008, cash entered the conversation again — creating a significant opportunity for advisors. In The Cash Opportunity for Advisors, we explore how focusing on cash can help you better serve your clients and grow your business. In the series, we cover what held-away cash is and why clients hold it, how to help clients make the most of their cash, and how a focus on cash can benefit advisors. In this, the first article of the series, we’ll begin by taking a closer look at the cash sitting in your clients’ bank accounts.

Understanding held-away cash

Held-away cash is simply the cash that sits outside a client’s portfolio, outside the purview of advisors. “While it’s often mentioned during the client onboarding process, advisors typically don’t revisit held-away cash in any level of detail with existing clients,” said Flourish President Ben Cruikshank. “Advisors intuitively know that clients keep some amount of cash in a bank account, but rarely take it into consideration when giving advice.”

Many advisors have been comfortable disregarding held-away cash because it wasn’t thought to be a major part of the client’s overall net worth. However, research has shown that cash reserves tend to be significant and that advisors are often in the dark about the scale.

“When we ask advisors how much cash their clients hold, the most frequent answer we hear is 1-2%, by which advisors mean the 1-2% of the portfolio held in cash for purely operational reasons,” said Cruikshank. “However, when you look at the data, it’s clear that high net worth individuals hold significant amounts of cash away from their advisors.”

How much cash do clients actually hold?

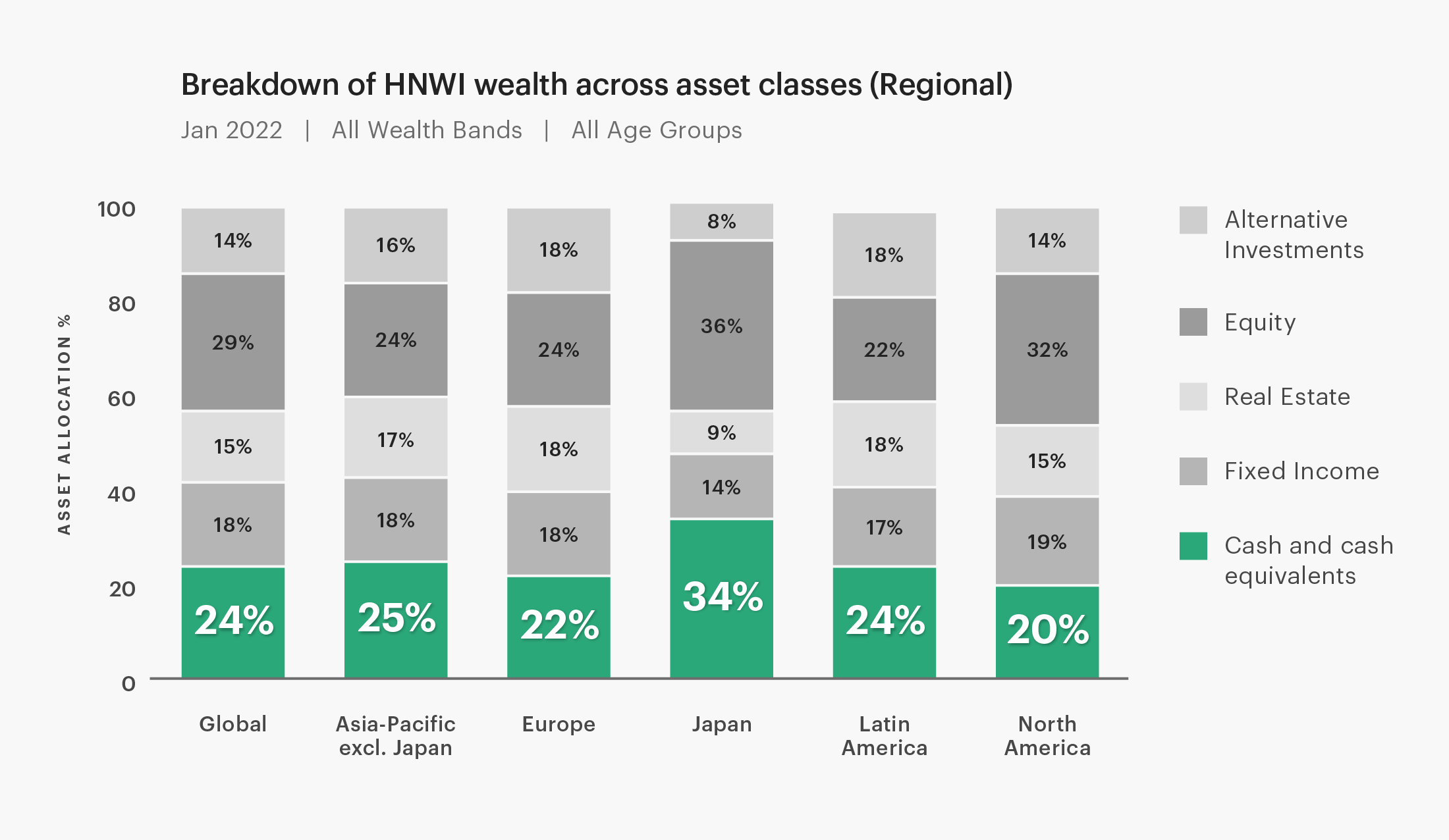

According to a 2022 Capgemini World Wealth report, people with at least $1 million in investable assets keep 20% of their net worth in cash.1

Source: Capgemini; data as of January 2022.

“When hearing this data for the first time, many advisors say ‘that may be true of other people’s clients, but certainly not for my clients’” said Cruikshank. “Ironically, many advisors have told us that while simultaneously admitting that they personally hold far too much in cash.”

To further understand how much cash the clients of RIAs actually hold, we took a look at data from Flourish Cash† customers.

Across 1,000+ RIAs that represent $2.6T in total end-client AUM and thousands of clients, we can see that households truly do have significant amounts of cash — and balances scale as net worth increases. Clients with a self-reported net worth of $1-2M hold an average of $217,528 in Flourish Cash accounts, while clients with a self-reported net worth of $5-10M hold an average of $426,686 in cash.|| And that’s just the money sitting in Flourish Cash.

So why are advisors blind to held-away cash? Cruikshank explained, “Advisors are great at managing things that sit inside the portfolio, under their visibility and control. Cash is different. Advisors often don't even start the conversation about held-away cash because they can't easily see it, manage it, or bill on it, and don’t have access to advisor-centric cash-management solutions.”

Recognizing the opportunity

Advisors who recognize that clients often hold significant amounts of held-away cash can turn this missed opportunity into an advantage.

Increased visibility into cash can help advisors provide more holistic advice to their clients, from better financial planning to ensuring that clients are taking appropriate risk in their portfolio, to helping clients earn a more competitive rate on their cash. After all, with an average household Flourish Cash account balance of $217,528 for clients with a self-reported net worth of $1-2M, a client that earns our rate as of 12/11/2025 of 3.25% APY§ on their cash for a year would earn more than $7,000 in interest. For a household with $1.5M in the portfolio, that would offset the majority of average advisory fees.

While future rates are uncertain and there is no guarantee that clients will continue to earn those rates, now could be an optimal time to help clients think strategically about their held-away cash — particularly in a time of economic volatility when clients are looking to their advisor for solutions. And if advisors don’t start the conversation, they should be aware that other firms — from wealth managers at private banks to robo-advisors — may attempt to build a relationship with their clients by presenting them with opportunities for their cash.

The held-away cash that clients have outside the orbit of the advisor deserves a second look. In the next article in this series, we explore the reasons why clients hold cash and how to take this understanding into conversations with your clients about opportunities to maximize the potential of cash.

About Flourish

Flourish builds technology that empowers financial advisors, improves financial lives and retirement outcomes, and delivers new and innovative investment options to advisors. Today, the Flourish platform is used by more than 1,000 wealth management firms representing more than $2.6 trillion in assets under management. Flourish is wholly-owned by Massachusetts Mutual Life Insurance Company (MassMutual). For more information, visit www.flourish.com.