Letter from Flourish CEO Max Lane:

Announcing the expansion and evolution of Flourish Annuities

Letter from Flourish CEO Max Lane:

Announcing the expansion and evolution of Flourish Annuities

May 1, 2025

Estimated reading time: 6 minutes

Dear Advisors,

I'm excited to share the next phase of Flourish Annuities,∫ a built-for-RIAs digital platform that’s redefining how annuities fit into modern financial planning. With this expansion, we’ve significantly broadened our marketplace to include all major fee-based annuity types and even more top-tier carriers. It’s a meaningful step forward, giving you the tools to easily deliver protected growth, guaranteed income, and tax-deferred solutions.††^^

At Flourish, we believe annuities have untapped potential to improve outcomes in ways traditional investment tools simply cannot. Yet for too long, these products have been out of reach for many advisors due to legacy systems, licensing hurdles, and operational drag. We believe RIAs deserve a platform designed around their needs—one that makes it easier to incorporate annuities into holistic portfolios.

This evolution reflects that vision, and it’s also the result of listening closely to you. Your feedback directly shaped what we’re launching today: a more comprehensive, more intuitive annuity experience, built to fit naturally into your planning process.

-1.png)

With this release, you can now incorporate a wider range of fee-based solutions into your planning conversations, all within a streamlined, easy, and delightful experience. Here are a few of the highlights:

1. Broader range of annuities

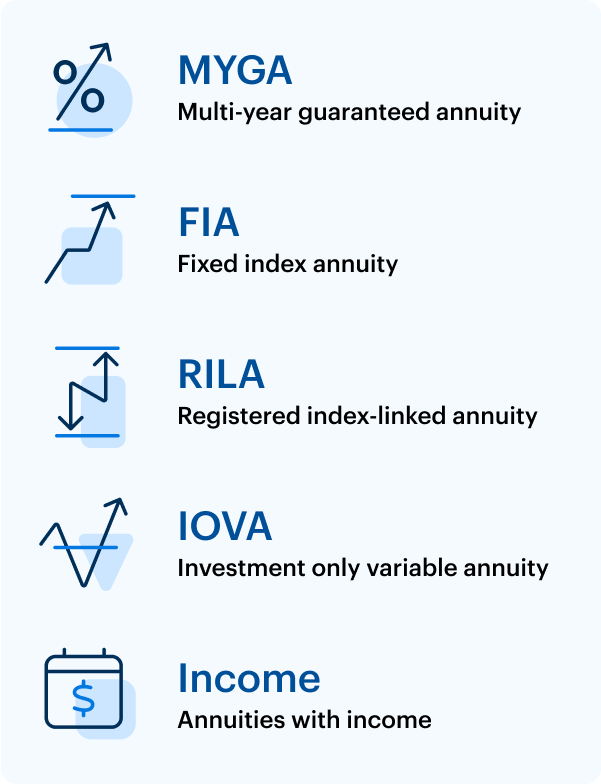

You now have access to a larger selection of fee-based annuities. Each option is designed to help meet a variety of client needs and provide you with even more powerful planning solutions.

This expanded range of products opens the door to new opportunities for growth beyond the traditional portfolio and increased protection in times of volatility. With options tailored to various goals, time horizons, and risk profiles, you can now incorporate annuities more strategically into holistic financial portfolios. The four growth-focused annuities we now offer are:

- MYGAs: Multi-year guaranteed annuities are a simple, predictable fixed income alternative for clients seeking guaranteed returns over a set term.

- FIAs: Fixed indexed annuities offer principal protection with the potential for market-linked growth, ideal for clients seeking growth with downside limits.

- RILAs: Registered index-linked annuities balance upside potential with defined downside protection, giving clients more control over risk and reward.

- IOVAs: Investment-only variable annuities offer tax-deferred growth with access to a broad range of investment options, designed primarily for clients with longer horizons or complex wealth strategies.

Together, these options give you more ways to support client goals, whether they're seeking market-linked performance, tax-deferred accumulation, or principal protection. For risk-averse and retired clients, the potential of protected growth can be especially powerful, particularly during times of market volatility, when downside control matters most. And just as important as growing wealth is the ability to turn it into lifelong income. That’s where the next part of our expansion comes in.

2. Income annuities built for today’s retirees

In a time of growing uncertainty, many clients are concerned about securing reliable retirement income. You can now meet this need with modern, fee-based solutions. Products in the Flourish Annuities marketplace have the option to add a guaranteed lifetime withdrawal benefit (GLWB) rider to eligible annuity contracts, which generate lifetime income while still preserving discretion over the underlying assets. Unlike traditional income annuities, clients don't have to fully relinquish control to receive steady income. It's a practical, advisor-friendly way to help solve one of the biggest challenges in retirement planning.

3. More enhancements, same seamless experience

With the recent additions, we've made it even easier to bring annuities into your process:

- Replacing outdated annuity contracts is one of the most common ways to deliver immediate value to clients and grow your billable assets. Whether you're lowering costs, improving flexibility, or consolidating legacy contracts, replacements are often an advisor’s entry point into annuity planning. With Flourish Annuities, it's now easier to confidently uncover better-fit solutions and take action.

- We've added more top-tier carriers, giving you and your clients a broader range of high-quality, curated choices.

- Our digital application process helps streamline implementation without the hassle of lengthy forms or manual paperwork.

- When you need support, our in-house, licensed insurance experts are here to help you with everything from evaluating existing policies and uncovering better-fit opportunities to portfolio review, product recommendation, and carrier communication management.

While the platform continues to grow, what you rely on stays the same. You'll still have the frictionless digital experience, deep integrations, and dedicated service team that make Flourish Annuities easy to use every step of the way.

-1.png)

Annuities are one of the most overlooked areas in client portfolios—and one of the most significant opportunities for advisors. Over $1 trillion in annuities were sold in just the last three years, often without the advisor's input or visibility.1 This tremendous growth demonstrates that investors are recognizing the valuable role that annuities can play in the portfolio and that many of your clients may already hold annuities. The advisors who can offer new annuities, manage existing ones, and provide more comprehensive guidance – all while increasing AUM – are poised to seize an incredible opportunity.

Flourish Annuities puts you back in the driver’s seat. It gives you tools to easily bring annuities into your process, turning a historically fragmented asset into a fully integrated part of your planning strategy.

With Flourish tools and integrations, you can easily evaluate how an annuity could elevate a client’s plan, whether they already own one that needs to be realigned to fit current goals or are exploring new options to bolster retirement confidence. The platform helps you assess current contracts, identify better-fit solutions, and make fiduciary-aligned recommendations without adding operational drag. Everything runs behind the scenes, so you can focus on delivering advice and strengthening relationships. Instead of a paperwork-intensive process, you’ll find an experience that’s streamlined, painless, and designed to leave bad annuity memories behind.

From day one, we’ve believed annuities should be an integral part of a broader fixed income and retirement strategy, not treated as a standalone product. That belief has shaped every step of our journey, from the initial launch of Flourish Annuities to today's expansion. As more advisors adopt a holistic approach to planning, we're proud to provide tools that help make that vision a reality.

And here's what we're most excited about: Flourish Annuities gives you a new way to grow your business. Annuity replacements may not only help improve client outcomes, they allow you to uncover held-away assets and bring them under your advisory umbrella. And that’s just the beginning. As clients become increasingly focused on stability, income, and protection, proactive annuity planning becomes a powerful engine for organic growth. By introducing new solutions tailored to evolving client goals, you expand your role, deepen relationships, and position yourself as the central, trusted financial expert for all of your client’s needs.

-1.png)

This expansion is part of a larger Flourish vision to improve the lives of advisors and clients via beautiful, elegant, innovative WealthTech solutions. Earlier this year, we announced our acquisition of Sora Finance, as part of our plan to launch a lending platform in 2026. Together with Flourish Annuities and Flourish Cash,† we're laying the foundation for a unified, advisor-first platform that makes it easier to implement true holistic planning across cash, insurance, and lending.

The future of WealthTech will be shaped by tools that fit naturally into advisor workflows. They should be integrated, easy to use, and built to help you deliver more value with less effort. Our focus is on turning planning into action so you can move from recommendations to implementation even faster. That's what fiduciary advisors need, that’s what clients want, and that's what we're building.

-1.png)

If you're already using Flourish Annuities, you’ll see the expanded marketplace in your dashboard. If you're new to the platform, our team is here to help with onboarding, training, or talking through a specific client need. Reach out for more information.

We'd love to hear what you think as your feedback helps us shape the platform and focus on what matters most to your practice.

As always, thank you again for being our partners and trusting us to deliver exceptional experiences for you and your clients.

Max

CEO, Flourish