November 6, 2025

Estimated reading time: 4 minutes

Flourish buckets are a simple, effective way to help clients manage their cash, track their savings progress, and stay motivated to reach their financial goals. Buckets allow clients to assign the funds in their Flourish Cash† account to specific categories or savings goals. Earmark funds for a vacation, credit card payment, emergency savings, upcoming wedding, and more. Business owners can assign funds to buckets for payroll, operating expenses, taxes, and more.

New clients will have the option to set up and customize their buckets during the account-opening process. Current Flourish clients can get started with buckets in a few easy steps:

What are Flourish buckets?

Flourish buckets are a way for you to assign the funds in a Flourish Cash account to specific categories or savings goals.

What can I save for with Flourish buckets?

Flourish buckets are customizable; you can create categories for any purpose. We provide preset options for some typical bucket categories for personal accounts, such as vacation, emergency fund, credit card payment, or home purchase, as well as for business accounts, such as operating funds, taxes, or payroll.

Am I required to set up buckets?

No, buckets are an optional way for you to organize the funds in your account and it is not required.

How do I set up buckets in my account?

New clients will have the option to set up buckets during the account-opening process.

Current Flourish clients can set up buckets in a few easy steps:

Can I set up buckets for my Flourish Cash business account?

Yes, we have specific business categories or you can make your own.

What is the maximum number of buckets that I can set up?

You can create up to 20 custom buckets per account, in addition to the primary bucket.

How can I automatically distribute incoming funds across buckets?

You can automatically distribute incoming funds across buckets by customizing your account’s deposit settings, which allows you to automatically distribute funds to specific buckets according to a specified percentage.

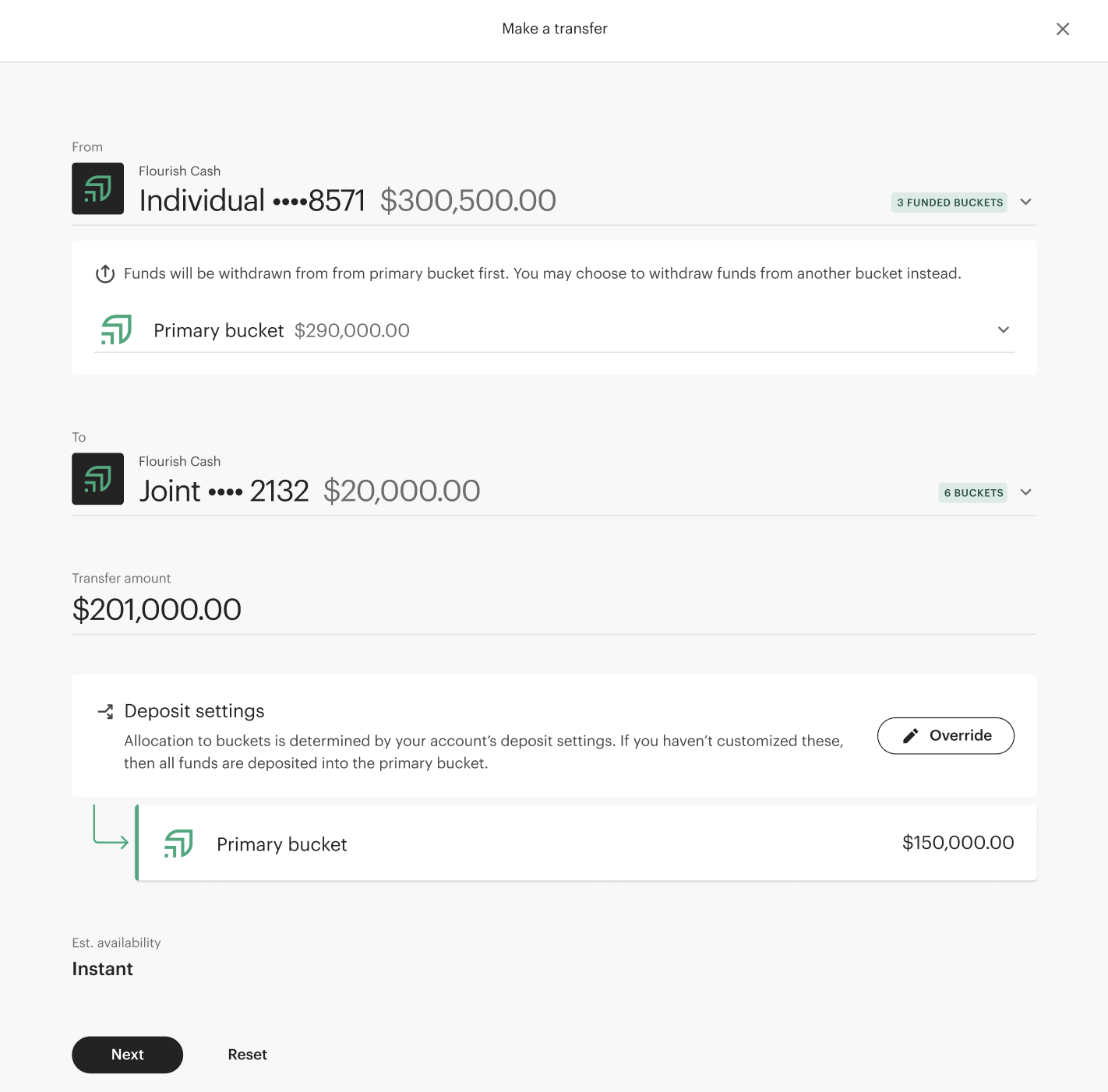

You can update your deposit settings at any time on the buckets page of your account or override these settings for individual transfers.

How do I move money between buckets?

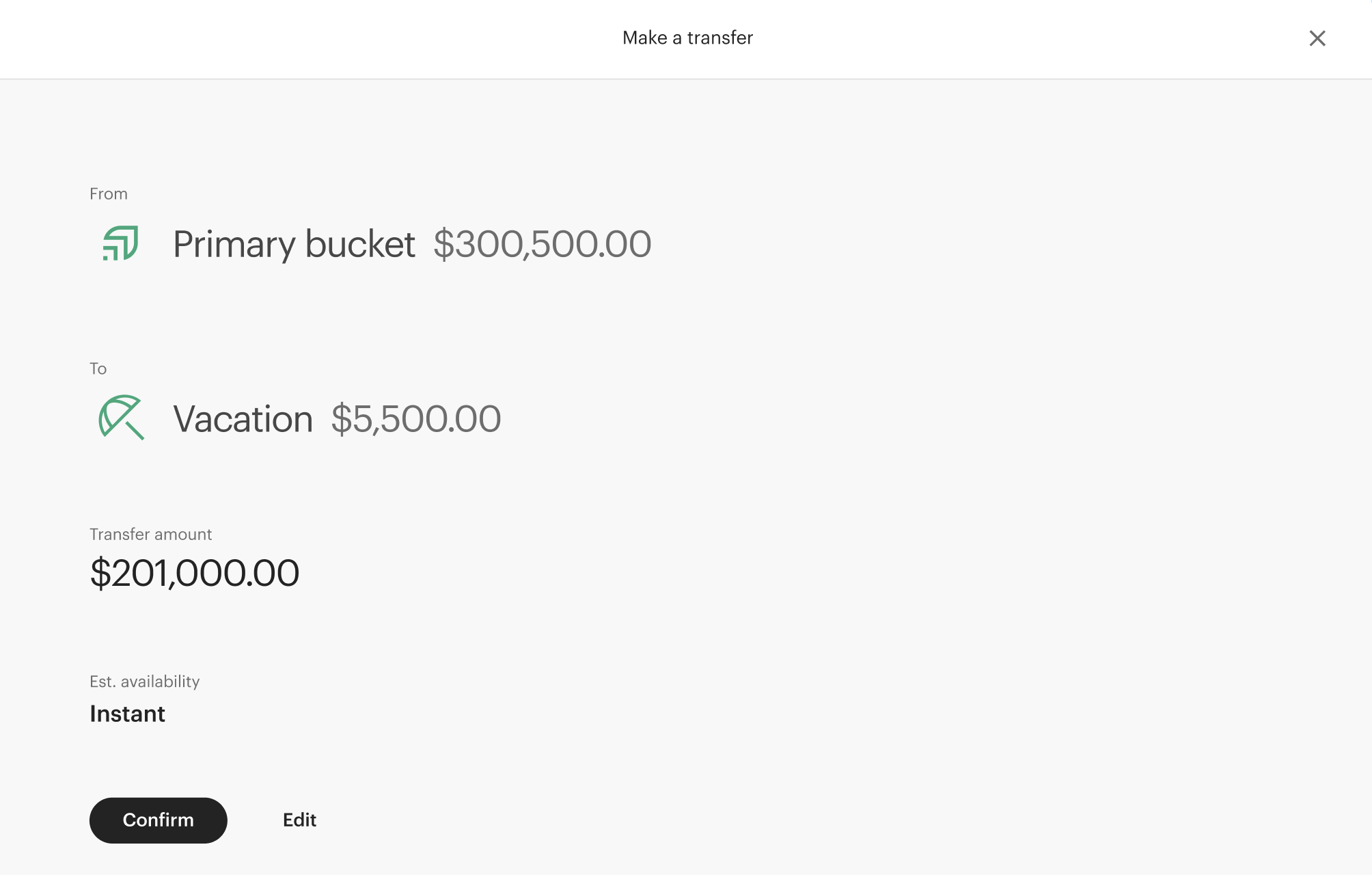

To transfer money between buckets within the same account, go to the ‘Buckets’ page of your account. Click ‘Transfer between buckets’ and then select the bucket you want to transfer funds from, and then select the destination bucket. Specify the transfer amount and click ‘Confirm.’ The funds will be instantly transferred.

To transfer money between buckets in different accounts — for example from your individual account to your joint account — select the account you’d like to ‘Manage’ from your dashboard and then click ‘Make a transfer.’ When specifying the account to withdraw funds from, you will be given the option to select a specific bucket from which to draw funds. When specifying the destination account, you will be given the option to select a specific bucket to which funds will be transferred.

Transferring funds between buckets within the same account.

Transferring funds between buckets in different accounts.

Can I deposit funds directly into a specific bucket?

Deposits initiated in the Flourish platform: For deposits into your Flourish Cash account that are initiated from within the Flourish platform, you can specify into which bucket(s) you would like the funds deposited or have the incoming deposit follow the account deposit settings. Deposit settings allow you to automatically distribute funds to specific buckets according to a specified percentage.

Deposits initiated outside of Flourish: Externally-initiated deposits, such as recurring paycheck direct deposit or an annual bonus, follow the account deposit settings. If deposit settings have not been customized, then the funds will be deposited directly into the primary bucket.

Incoming wire transfers (sent into Flourish account): Incoming wire transfers follow the account deposit settings. If deposit settings have not been customized, then the wire transfer will be deposited directly into the primary bucket.

Can I withdraw funds directly from a specific bucket?

Withdrawals initiated in the Flourish platform: For withdrawals from your Flourish Cash account that are initiated from within the Flourish platform, you can specify from which bucket(s) you would like the funds drawn.

Withdrawals initiated outside of Flourish: Externally-initiated withdrawals, such as automatic monthly credit card payments or annual insurance premiums, pull from the primary bucket first.

Outgoing wire transfers (sent out of Flourish account): Funds withdrawn from your Flourish Cash account via wire transfer will be drawn from your primary bucket and then, if needed, from your bucket(s) with next-highest balance(s). This process is done together with the Client Support team.

How do Recurring Transfers work with buckets?

For recurring transfers, deposits follow the account deposit settings. To make any changes on an individual transfer created as part of the recurring series, you must wait for the transfer to be scheduled and then edit it from within the Flourish platform, or you can edit your account’s deposit settings and the recurring transfer series will follow these updated settings.

Recurring withdrawals will be drawn from the primary bucket first, and then, if needed, from your bucket(s) with next-highest balance(s). To make any changes on an individual transfer created as part of the recurring series, you must wait for the transfer to be scheduled and then edit it from within the Flourish platform.

How does SmartBalance work with buckets?

SmartBalance is set up at the account level, meaning it checks your total Flourish Cash account balance, not specific bucket balances within the account. All incoming SmartBalance transfers will be deposited according to your Flourish Cash account’s deposit settings. If deposit settings have not been customized, then the funds will be deposited directly into the primary bucket. All outgoing transfers will be withdrawn from your primary bucket first and then, if needed, from your bucket(s) with next-highest balance(s).

Do my buckets have unique account and/or routing numbers?

No, buckets are not accounts or sub-accounts, and so do not have distinct account or routing numbers. Your Flourish Cash account will continue to have the same account number and routing number as today.

What if a bucket doesn't have sufficient funds for a specific withdrawal?

If the transfer amount exceeds the funds available in the bucket you selected, the remaining amount will be withdrawn from your primary bucket and, if necessary, then from the bucket(s) with the next-highest balance(s).

What is an override?

For individual transfers, you can override the account deposit settings, which allows you to allocate a specific dollar amount of a transfer to specific bucket(s).

What are deposit settings?

Deposit settings allow you to automatically distribute funds to specific buckets according to a specified percentage. To set up deposit settings:

You can update these settings at any time on your buckets page, or override these settings for individual transfers.

Can I delete buckets?

Yes, you can delete custom buckets from your ‘Buckets’ page, but you cannot delete the primary bucket for the account. A bucket cannot be deleted if it is specified in the account’s deposit settings or if it has a pending transfer. If a bucket is specified in the deposit settings, you will need to update the deposit settings before deleting the bucket. If there is a pending transfer for the bucket, then once the transfer is complete, the funds can be moved and the bucket deleted.

Can I edit buckets?

Yes, you can customize the bucket category, nickname, and goal amount on all custom buckets. The primary bucket cannot be edited or deleted.

Can I create multiple buckets of the same category?

Yes, as long as they have unique nicknames.

Can I make a bucket in any type of Flourish Cash account?

Yes, buckets are available for individual, joint, trust, and business accounts.

Do I receive the same interest rate and FDIC coverage on my buckets?

Yes, your interest rate§ and FDIC insurance coverage through the Program BanksΩ is applicable to the entirety of your account balance. View current rates and coverage in our program summary.

Does each bucket earn interest separately?

No, interest is earned at the account level and paid into the primary bucket.

Will buckets appear in my QuickBooks or Quicken account?

No, buckets are not reflected in the data exported to QuickBooks or Quicken.

How will you issue my 1099 if I have set up buckets?

There will be no changes to 1099-INTs for accounts with buckets. You will continue to receive one 1099 per account. Buckets will not be itemized on your 1099.

Will buckets appear on my monthly statement?

There will be no changes to monthly statements for accounts with buckets. You will continue to receive one monthly statement per account. Buckets will not be itemized on your monthly statement.

If I have funds in my Flourish Cash account and I create buckets, then where does my money go?

All account funds are moved into the primary bucket. You can then instantly move funds between buckets within the same account.

Can my advisor manage buckets for me?

If account visibility settings are turned on, advisors can view your buckets and bucket-level activities.∆ Advisors cannot actively manage buckets. Any advisor-initiated transfers to linked brokerage accounts will pull funds from the primary bucket, and then, if needed, from your bucket(s) with next-highest balance(s).

If you have any additional questions, please reach out to our Client Support team and they'll be happy to help.

If you have any additional questions, please reach out to our Client Support team and they'll be happy to help.

About Flourish

Flourish builds technology that empowers financial advisors, improves financial lives and retirement outcomes, and delivers new and innovative investment options to advisors. Today, the Flourish platform is used by more than 1,000 wealth management firms representing more than $2.6 trillion in assets under management. Flourish is wholly-owned by MassMutual. For more information, visit www.flourish.com.

† A Flourish Cash account is a brokerage account offered by Flourish Financial LLC, a registered broker-dealer and FINRA member. Flourish Financial LLC is not a bank. Check the background of Flourish Financial LLC and its personnel on FINRA's BrokerCheck. The cash balance in a Flourish Cash account will be swept from the brokerage account to deposit account(s) at one or more third-party Program Banks that have agreed to accept deposits from customers of Flourish Financial LLC. The accounts at Program Banks will pay a variable rate of interest.

Ω The cash balance in a Flourish Cash account that is swept to one or more Program Banks is eligible for FDIC insurance, subject to FDIC rules, including aggregate insurance coverage limits. FDIC insurance will not be provided until funds arrive at the Program Bank. The current list of Program Banks can be found here. Customers are generally eligible for FDIC insurance coverage of $250,000 per customer, per Program Bank, for each account ownership category. FDIC insurance coverage details can be found in the program summary. If the number of Program Banks decreases for a customer (for instance, because a customer chooses to exclude Program Banks from receiving their deposits), the amount of FDIC insurance through Flourish Cash could be lower. Customers are responsible for monitoring whether they maintain deposits at a Program Bank outside of Flourish Cash and should consider choosing to exclude that Program Bank from receiving their deposits to avoid exceeding FDIC insurance limits. Although Flourish Cash is offered through a brokerage account and cash held in brokerage accounts often has the benefit of SIPC protection, until such time as we offer securities products, customers likely will not have the benefit of SIPC protection. SIPC protection is not available for cash held at the Program Banks. For additional information regarding FDIC coverage, visit https://fdic.gov/.

∆ An advisor’s ability to view client account information is subject to applicable privacy laws and clients' consent to such sharing.