How Flourish Annuities seamlessly integrates with your RIA tech stack

Letter from Flourish CEO Max Lane:

Announcing the expansion and evolution of Flourish Annuities

June 4, 2025

Estimated reading time: 4 minutes

Annuities have long been out of step with the RIA model – not for lack of value, but because of too many associated hurdles: licensing requirements, a tedium of paperwork, and operational headaches caused by outdated processes.

Today, demand for annuities is quickly rising. Investors are looking for protection, reliable income in retirement, and additional tax advantages – and they are asking more questions than ever.††^^ But most advisors still don’t have a simple, fiduciary-friendly way to deliver the right solutions.

Flourish Annuities∫ was built to change that.

Flourish Annuities is a modern, digital-first solution that gives advisors access to a marketplace of fee-based annuities on a platform that fits seamlessly into existing advisor systems. No advisor insurance licenses or operational changes are required. Just a smart, clean way to offer annuities as part of the overall portfolio strategy.

What was a paperwork-heavy, time-consuming process is now digital, streamlined, and built for an ideal client and advisor experience.

Flourish Annuities was built with one goal: to make annuities work for RIAs without changing how RIAs work. Our platform serves as your centralized, digital-first workspace for all things annuities. You can research and share proposals for annuity solutions from top-rated carriers, then initiate the application process. The integration setup is straightforward and our experienced team of Annuities Specialists is always available to assist, whether in the background or working collaboratively with you and your client.

Because Flourish integrates directly into the tools you already use, annuities can become part of the portfolio — not something separate from it. Once a contract is issued, key data flows automatically into key reporting and planning systems, so you can track annuity performance just like any other asset. No spreadsheets. No follow-ups with carriers.

Clients gain access to more retirement planning options, including the ability to use a 1035 exchange to replace an outdated or underperforming annuity with a more efficient one — often without triggering a taxable event.^^

For your firm, that means greater wallet share, better visibility, and new opportunities to grow AUM. With no commissions and full fee transparency, Flourish fits easily into a fiduciary practice.

Flourish combines modern technology, back-office support, and client-centric design to make annuities a streamlined part of your tech stack and a smart addition to your practice.

Flourish Annuities is built to work the way you do. From application through policy issuance and ongoing servicing, the entire annuity lifecycle is centralized in one digital platform — with direct integrations with the systems you already rely on.

Once a contract is issued, key data flows automatically from Flourish to your reporting partners. That means cleaner data, fewer manual tasks, and complete transparency across your client's portfolio. No spreadsheets or back-and-forth with carriers are required.

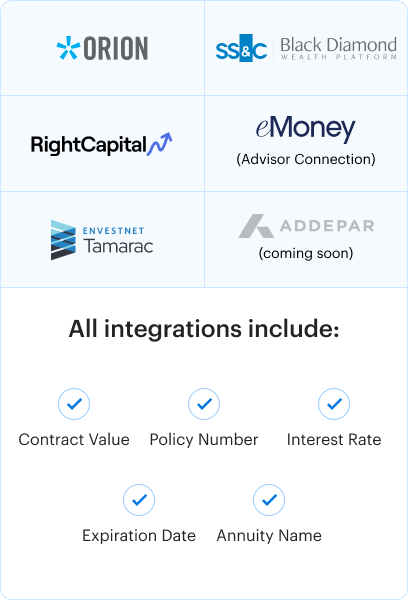

Flourish recently expanded its integration with Envestnet | Tamarac to include annuities data, joining a growing list of supported platforms. More integrations are on the way, so annuities will be right there with you wherever you work, seamlessly embedded in your existing tech stack.

Flourish Annuities integrates with leading reporting and planning tools to provide key annuity information:

.png)

By removing the complexity and headaches that have historically surrounded annuities, Flourish Annuities is making it easier for RIAs to deliver on the promise of holistic planning. You can offer the right products at the right time with a platform built to work seamlessly within your existing tech stack. It’s a modern approach to an overlooked part of the portfolio and a strategic opportunity to add value that clients and prospects will notice.

To learn more about how Flourish Annuities can help your practice grow, reach out to our team of Annuities Specialists.